Achieving Equitable Outcomes

Tom Flaherty is a Senior Advisor at EY-Parthenon, Ernst & Young LLP, in Dallas.

Muss Akram is a Senior Director at EY-Parthenon, Ernst & Young LLP, in Houston.

In the November edition of Public Utilities Fortnightly, we introduced the need for heightened attention by utilities to address the trend in uneven distribution of transaction-related regulatory outcomes. Part One discussed the relevant elements and impacts of benefits and costs, while also introducing the nature and implications of shareholder and customer risks assumed in a transaction.

This description primed the pump for a more important discussion. What does a comprehensive regulatory plan look like to provide the breadth and depth of information utilities need to demonstrate to justify more equitable transaction outcomes are necessary, and regulators need to have in-hand to effectively consider how to better apportion risks, synergies, and costs?

Crafting the Plan

Given the significance of obtaining an equitable regulatory outcome, particularly as transaction scale and value-at-risk continue to increase, the importance of a well-crafted regulatory plan has never been higher. Unfortunately, the dichotomy in views about what this looks like between utilities, regulators, and intervenors is particularly stark.

The regulatory plan developed by combining utilities needs to rechallenge its historical purpose and move from an obligatory filing component to an instructive, qualitative, and quantitative demonstration of value created and provided only by the transaction. The plan needs to address critical themes and evidentiary dimensions necessary to fully frame the presentation of merger benefit creation and subsequent sharing, particularly the equitable outcome desired from the merger approval proceeding.

Utilities need to clearly assess the current regulatory environment that, while generally supportive of mergers, is less constructive in devising and ensuring equitable results for shareholders. Companies need to step back and define first principles for equitable merger benefit distribution outcomes.

This requires an enhanced framework to guide the presentation of related principles, rationales, facts, impacts, and results related to merger benefits sharing.

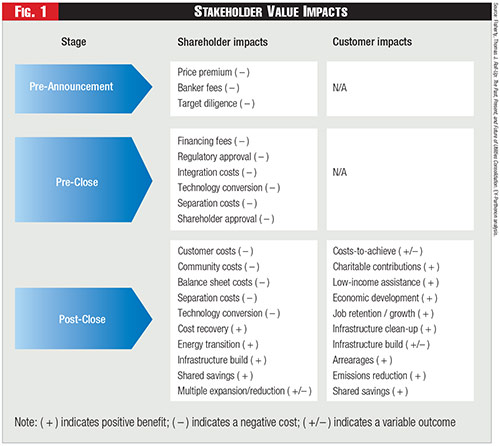

Future approval applications need to include a comprehensive and detailed discussion of the multiple dimensions of merger benefits: foundational assumptions, lifecycle risks, nature of benefits and related costs, timing of outflows and inflows, benefits distribution impacts, and overall outcome symmetry, as summarized below:

Shareholder risks:This often overlooked and misconstrued topic relates to the risks assumed by shareholders in financing, enabling, and supporting the merger from idea inception through and beyond ultimate close. The regulatory plan needs to fully discuss the relationship of these risks to end-to-end merger execution and establish a framework for their recognition.

Synergies elements:As a centerpiece of most mergers, reduced O&M and fuel costs are fundamental to addressing a public-interest test, but they are often lightly discussed in approval applications, if at all. The regulatory plan should fully describe the derivation, level, and attainability of synergies, which are a table stake for demonstrating proof of merger value.

Synergies timing:The attainment of synergies takes several years, which is an important dimension of consideration of synergies distribution timing. Merger synergies can only be realized once the transaction is closed, and they do not go positive until sometime in the second year, which bears full demonstration and discussion in the regulatory plan.

Costs to achieve:Every merger incurs out-of-pocket costs to make the combination happen and bring anticipated benefits to fruition — they are a requirement for transactions and are pivotal to outcomes. While costs to achieve are the reverse of synergies in timing (such as heavily up front vs. ramping up over time), they are not discretionary or avoidable, and cannot simply be ignored.

Synergies distribution: The critical outcome of a merger application approval process is the direction by regulators on how net merger synergies are to be shared between shareholders (the providers) and customers (the beneficiaries). If regulators optimize customer value at the expense of shareholders, then customer benefits from the instant and future transactions will be at risk.

Ongoing value recognition:Approval applications typically address near-term synergies impacts linked to only the next rate case when O&M cost levels would be reconsidered. The regulatory plan needs to propose and justify multi-year mechanisms that recognize the continuing nature of synergies benefits to customers and enable a more equitable and longer benefits distribution to reflect shareholder risks.

Commitments and conditions:Regulators incorporate discrete commitments (such as low-income support, economic development, new investment, foregone arrearages) and specific conditions (such as dividend restrictions, financing capacity, notice provisions, headquarters staffing). The regulatory plan should acknowledge these items, particularly soft or hard commitments that can add to overall deal value.

Total benefits: While the public-interest test typically focuses on direct customer benefits, broad value sources exist to build traditional benefits (such as new jobs, new facilities, grid modernization) with nontraditional horizon sources (such as accelerated fossil retirements, future transition end-state readiness, net-zero emissions attainment), creating powerful public-interest benefits.

Synergies tracking: Regulatory commission requirements to formally track and report achieved net synergies against expectations for attainment are a common trend in recent transactions. The regulatory plan should propose how synergies and costs-to-achieve are to be efficiently captured through existing mechanisms for regulatory reporting.

With a robust regulatory plan as part of the approval application, utilities can position themselves to increase regulator awareness of transaction risks, benefits, costs, and equity, and increase the potential to achieve an equitable and extended financial outcome from the transaction in the form of continued synergies sharing.

When combining utilities prepare their regulatory plan, the provided information should present a multi-year view of benefits and a robust and compelling delineation of outcomes, including a terminal value calculation to provide an all-in view of shareholder and customer distribution.

Regardless of type, timing or duration, these comprehensive benefits need to be reflected to create a value scorecard for regulators to determine how to apportion benefits between shareholders and customers.

When a multi-dimension, multi-year view of benefits is provided, it is then possible for regulators and all parties to the proceeding to obtain a fully informed perspective of the relationship between risks and apportionment, synergies and costs, and distribution and equity.

Equitable Results

Utilities and their shareholders undertake combinations with the expectation they will be treated fairly in recognizing financial commitments made, and risks taken, from approval application filing through years after the close.

Like being allowed the opportunity to earn the authorized return in a rate case, the corollary for a merger transaction is that utilities will be afforded the opportunity to be compensated for risks assumed over the course of the transaction and the costs incurred to enable benefits to customers to be realized.

Utilities know that a regulatory application approval process does not always follow a standard methodology for how specific outcomes are derived, even if relevant precedents exist. They realize that they bear the burden of proof to provide comprehensive information and specific analyses to justify desired results.

Utilities need to provide a full set of data, rationales, and outcomes that make it easier for regulatory commissions to understand the fairness and financial trade-offs that exist and the direct advantages to all stakeholders of achieving equitable benefits sharing.

When the breadth of transaction risks between shareholders and customers is individually and collectively considered, it's clear that a disproportionate level falls to shareholders. Recognition of these risks does not mean shareholders should automatically receive a disproportionate amount of the benefits from the transaction. But it does mean they should be treated fairly in how benefits are shared with customers, which implies an equitable sharing.

See Figure One.

While regulators do not necessarily need to incent utility combinations to occur, they also do not need to take actions that dis-incent pursuit. Several tenets provide a foundation to frame the sharing of savings between shareholders and customers in a typical merger:

Shareholders bear a range of risks throughout the transaction process that exceed those borne by customers; shareholders are only rewarded for these risks through a fair synergies sharing outcome; costs-to-achieve are a necessary element of achieving a deal and realizing synergies; merger synergies exceed costs-to-achieve to create net synergies; net synergies to customers will generally extend into perpetuity; and absent a formal designation of ongoing net synergies sharing for shareholders, the risks they have already, and will continue to assume, are inadequately recognized or recompensed.

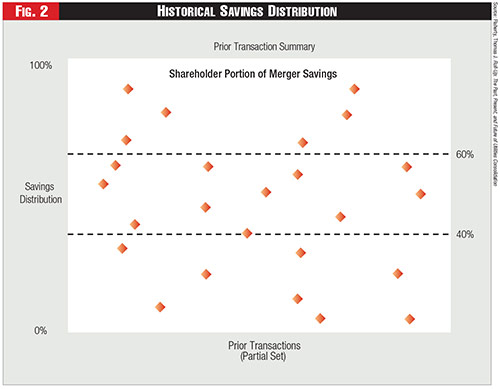

To recompense shareholders for the risks assumed does not suggest that net synergies need to be shared equally, but it is not a bad place to start. An equal fifty/fifty net synergies sharing certainly is fair, given the risks borne by shareholders, recognizes the relationship between merger synergies and costs to achieve, and has the benefit of regulators adopting this approach in numerous prior transactions. This sharing level also signifies a recognition that no synergies would be available if a transaction were not previously funded by shareholders.

See Figure Two.

However, other factors can come into consideration. Fuel supply synergies exist in many transactions, and, as a typical hundred percent pass-through charge, they naturally flow to customers via traditional fuel clauses. Thus, the combination of fuel supply savings and net synergies automatically skew these savings toward customers and create an asymmetrical benefit sharing, unless otherwise recognized and addressed.

Similarly, corporate center synergies may also be allocated to nonregulated businesses that a utility maintains outside the regulated cost of service, thus reducing the level of net synergies available to customers. In this case, net synergies could naturally skew toward shareholders if not reflected.

Under these examples, either shareholder or customer sharing of total net synergies might not be equal (such as sixty/forty to customers) but could still be equitable overall if fifty/fifty sharing of regulated, nonfuel net synergies is maintained. They could also be equitable if total regulated and nonregulated merger net synergies flowed sixty/forty to shareholders if fifty-fifty sharing of regulated net synergies is still maintained for customers.

Absolute sharing can also reflect rate moratoriums that cause a hundred percent of nonfuel net synergies (without an upfront rate credit) to inure to shareholders until the next rate case is filed, typically within two to four years. With this short-term advantage to shareholders, regulators typically fully claim net synergies for customers for all future periods.

But is a fixed, short-term net synergies sharing model equitable for savings distribution when savings realization for customers continues year after year into the future? On the surface, it appears highly inequitable, given the disproportionate level of front-end risks assumed and the gradual ramp-up of merger net savings until steady state in year three.

When costs-to-achieve incurrence can offset available synergies for most of the first three years after close, it becomes continually more asymmetric to customers in succeeding years as synergies escalate and no mechanism exists for shareholders to participate in any ongoing benefits.

The solution is to extend the duration of net synergies sharing for shareholders into future years through redetermination of a traditional short-term symmetric shareholder — customer split of fifty/fifty, to a level more directed toward customers, such as seventy/thirty, over a defined period.

Another approach is to use a return-on-equity band that provides a range-of-return upside to shareholders if the authorized return is exceeded by synergies realization, say fifteen to twenty-five basis points, for a fixed period to recognize prior risks and the availability of net synergies into perpetuity.

A third approach creates a deferred asset for ongoing net synergies with a specific level of annual amortized savings recognition, agreed sharing distribution, and defined period (such as seven years). Under this approach, customers continue to receive annual benefits into perpetuity, while shareholders are provided with the opportunity for additional near-term net synergies capture. Recognizing the typical skew of total net synergies realized by customers compared to those relegated to shareholders would further recompense investors for the risks that were originally incurred and are continually borne.

Adopting a multi-period net synergies sharing framework is best done in the merger application approval process, when all factors can be considered together, rather than in a later rate case, when revisiting merger outcomes is less likely. If other regulatory decisions further disadvantage shareholders and the utility (such as disallowance of out-of-pocket costs to achieve or cost write-offs), then net synergies sharing would further skew toward customers and necessitate additional recognition by regulators to avoid a one-sided, inequitable outcome.

Pursuing an equitable outcome in every merger proceeding should be the ultimate objective of all combining companies, but it is not an easy undertaking; shareholder risks, synergies levels, costs-to-achieve legitimacy, and benefits distribution are all argued from different perspectives. While the goal of an equitable outcome seems relatively straightforward, the variability in philosophies, rationales, policies, and practices creates a complex regulatory environment for utilities to navigate.

To have a real opportunity to achieve a fair and equitable merger outcome, utilities need to emphasize the construction of a comprehensive, cogent, and compelling regulatory plan that sets forth the logic and rationale of risk apportionment, net synergies, and savings sharing sought in the merger application approval order.

A well-constructed regulatory plan is the most critical element of the application approval filing since it enables utilities to demonstrate how the entire range of merger actions and impacts culminate in an equitable overall sharing of merger benefits over the near- and long-term.

The views expressed in this article are those of the author and do not necessarily reflect the views of Ernst & Young LLP or other members of the global EY organization.

Category (Actual):

Department: