Achieving Equitable Outcomes

Tom Flaherty is a Senior Advisor at EY-Parthenon, Ernst & Young LLP, in Dallas, and author of “Roll-Up: The Past, Present, and Future of Utilities Consolidation.”

Muss Akram is a Senior Director at EY-Parthenon, Ernst & Young LLP, in Houston.

Utilities consolidation since 1995 is well chronicled, yet its accomplishments are often unappreciated. Prior transactions have slowed customer rate growth, strengthened utility financial capacity, and enabled capital investment in grid hardening and modernization, creating benefits inuring to shareholders and customers alike.

While future mergers and acquisitions will continue this focus, an even more valuable benefit exists — accelerating the transition to a net-zero world through synergies deployment — but only if convincing regulatory plans are created by utilities, and only if equitable merger outcomes can be realized between shareholders and customers.

When the next U.S. utility stock-for-stock merger or acquisition occurs, company managements will again need to decide how to pursue its approval by state regulators, particularly how to balance risks, synergies, costs-to-achieve, and short- and long-term benefits among key stakeholders.

On one hand, utilities and shareholders are intent on ensuring that transaction requirements and outcomes are not one-sided. Regulators and intervenors are equally resolved to deliver and safeguard meaningful rate-level impacts and other benefits to customers.

This divergence in perspective reflects natural positions of utilities and regulators over value creation and benefits realization and creates an obvious conflict in priorities and expectations between the two. It frames the pivotal challenges to achieving a fair and equitable outcome for benefits distribution between shareholders and customers.

Four critical transaction components define success in a merger — bid prices, net synergies (after costs-to-achieve), regulatory approvals, and integration execution — and all work in concert. But the most influential item emerging from a merger application approval process is the final regulatory order that defines how net synergies distribution will occur and whether the merger outcome yields equitable or asymmetric results.

In many prior transactions, desired and realized outcomes for net synergies distribution were closely aligned. Regulatory approval decisions were largely balanced between shareholders and customers, providing symmetrical near-term outcomes (such as fifty/fifty sharing of net synergies). This result blended the principle of recognition of shareholder-assumed risks and costs with its counterpart of ensuring customers directly receive tangible benefits from a transaction.

More recently, these principles have become skewed, and net synergies sharing outcomes have become more asymmetric, with most benefits inuring to customers and little or no recognition of shareholder risks in underlying decisions. This outcome diminishes the risks and costs shareholders bear in underwriting a proposed transaction, expecting fair regulatory outcomes, enabling merger benefits to be created, and counting on management's capability to effectively execute through the regulatory approval process and beyond the close.

Traditionally, utilities file an application for merger approval that provides the case for the transaction (such as its logic, structure, financing, benefits, impacts, protections, and commitments). The company's regulatory plan — how much, how,and when it proposes to distribute available benefits — is a centerpiece of this application and forms the basis for a substantial portion of the subsequent engagement around the merits of the application.

While each of these application elements is an essential component of the whole, individually, they do not reflect all critical dimensions that comprise a comprehensive and integrated regulatory plan. Future regulatory plans need to model their approval applications to provide more comprehensive and compelling information to regulators that frame transaction relationships that matter (such as risks and benefits, synergies and costs-to-achieve, decisions and impacts, and short- and long-term results).

To high-grade future approval applications, utilities need to reassess their philosophies, models, and approaches to design of regulatory approval strategies and plans. Plan modifications and enhancements to address continuing adverse trends need to result in thoughtful foundational principles, clear risk articulation, broad value demonstration, expanded empirical evidence, creatively crafted sharing, responsive alternative offerings, and innovative issue resolution approaches.

If utilities are successful in making the case for equitable outcomes among stakeholders, value destruction can be avoided, sustained customer benefits enjoyed, and the transition to net-zero accelerated.

Benefits and Costs

Utility merger transactions produce a wide range of tangible and intangible benefits from combination. While merger synergies are the most visible transaction element, they are often complemented by other factors, such as new assets, accelerated infrastructure, economic development, job creation, community funding, new product offerings, improved system reliability, increased security of supply, enhanced environmental outcomes, employee opportunities, and targeted forms of customer protection and bill relief.

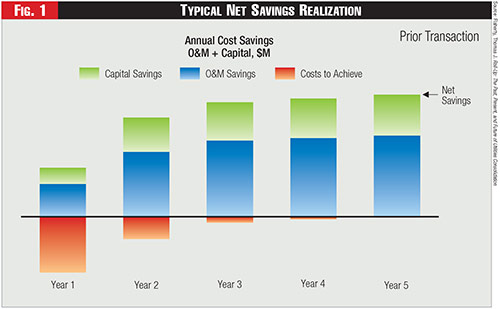

Conventional merger synergies result from avoidance of duplication and overlap, capture of economies of scale, and avoidance of related capital expenditures. These sources shape the core value elements of a combination between two utilities and are easily discernable, estimable, and quantifiable with reasonably good precision. Reducing operating and maintenance (O&M) expenses achieves lower future rate levels and provides a recurring yardstick for assessing ongoing merger benefits.

Typical merger synergies are estimated for a five-year period, sometimes longer if distinctive future events are expected. These multiyear values can be specifically determined and linked directly to decisions made by management. These merger synergies ramp up over a three-year period to reflect integration progress, then usually escalate with inflation.

See Figure 1.

However, combining two companies to produce expected merger benefits does not occur without significant out-of-pocket costs to structure, finance, approve, integrate, and execute a transaction so that available synergies and other benefits can be attained. These costs start well before an agreed transaction is ever announced and continue for years after deal closing.

Consequently, merger synergies and costs to achieve do not move in tandem, as synergies realization substantially lags costs-to-achieve incurrence, while the companies take time to integrate them. Net synergies turn positive in the second year post close, begin to grow through post-close implementation, and then continue into perpetuity after year three while costs to achieve dissipate.

With this pattern, it's easy to see how dichotomous outcomes between shareholders and customers emerge immediately at transaction close and last into succeeding years. The timing lag between synergies realized and costs incurred creates unavoidable risks and a skewed outcome between shareholders and customers from day one post close, even before synergies distribution begins. This observable pattern of risk and reward frames a critical part of the challenge to achieving equitable merger outcomes for companies and regulators to jointly solve.

Shareholder and Customer Risks

When utilities pursue mergers and acquisitions, they do not control the nature and impact of regulatory decisions. Similarly, utilities do not carry a perception that they will receive the exact outcomes they seek. However, they do have an expectation that both they and their customers will be treated fairly, and that merger approval will not result in value destruction to their companies.

While there is no explicit regulatory compact that applies to the outcomes of merger transaction approval proceedings — like that existing in traditional rate case proceedings — conventional thinking is that both shareholders and customers need to be treated fairly through decisions reached by regulators.

Shareholders need to be recompensed for the risks they accept to achieve a successful transaction outcome, while customers need to benefit for their previous support of higher O&M costs pre-merger.

Shareholders are vital to the accomplishment of a proposed merger — they provide the capital, assume the market risk, and rely on management's ability to execute. They recognize that the role they play in enabling a transaction to occur does not convey an entitlement to a particular outcome. Shareholders are experienced with regulatory processes and understand the vagaries of multi-intervenor, multistate proceedings.

But shareholders still expect the regulatory order will balance interests in a manner that incents capital commitment to fund a transaction and provides tangible impacts that either lower current rates or slow the rate of future increases.

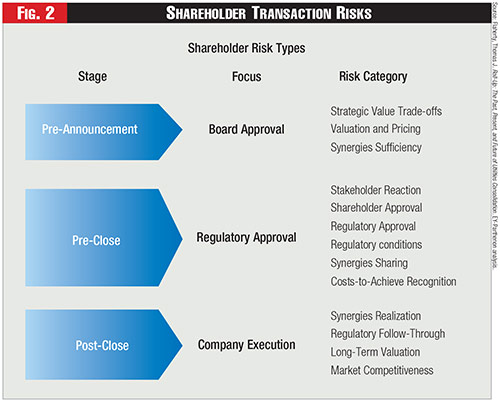

From a shareholder perspective, this group incurs risks throughout the transaction lifecycle, from pre-announcement, through pre-close preparation and approval, and beyond close. These three transaction time frames include a wide range of individual risks spanning from deal logic and early financial structuring to application approval process fairness and equity to ongoing market, financial, and operating success.

See Figure 2.

These risks are numerous and impactful, if not adequately recognized and effectively addressed. Even before a deal is struck, shareholders assume that management has identified the right target to pursue, and the proposed transaction produces strategic value to advance the market position of the acquiror.

Shareholders also assume that valuation of the target, structuring of the transaction, and pricing of the bid align to create value to the acquiror. Thus, early high-level analyses need to indicate the combination can produce the level of synergies and other benefits sources that make transaction pursuit worthwhile.

If management of an acquiring utility cannot anticipate an equitable outcome to shareholders across the relevant state regulatory jurisdictions, its board of directors cannot authorize further pursuit of a target, and the transaction will be terminated before ever getting to the regulatory approval stage. This outcome can chill utility management interest in further transaction pursuits, even one in a different jurisdiction.

Deal-breaker risks are borne by shareholders pre-close during the approval application process. Here, the transaction can unravel quickly if all stakeholders are not convinced the proposed transaction has sound strategic logic, effective structuring, appropriate pricing, and little operating risk. These concerns show up early as shareholders provide first approval of the transaction and closely assess potential impacts to them and the company.

Early regulator or intervenor adverse reactions about synergies levels, costs to achieve, net savings distribution, and sharing timing can set a negative tone early in the process requiring resolution. Finally, the ability to achieve regulatory approval in a reasonable time frame to provide an equitable outcome depends on how the above risks are navigated through the application approval process.

If insurmountable risks to approval exist at this stage, anticipated value to the acquiring and combined utility through available strategic, financial, and operating levers — what might have been — will not be attained. Also, the fully guaranteed benefits to customers from realized synergies will be permanently foregone.

The last shareholder risk category occurs post close when the integration of combining companies is conducted. The risk of not capturing anticipated synergies exists here as original assumptions are either proven or a shortfall occurs.

In the post-close period, the combined company seeks to advance its overall business and build future value and market position that will not be realized for several years. A real risk exists that future regulators not originally involved with original transaction approvals may think differently about matters that come before them, as well as post-close regulatory assumptions that do not come to fruition.

Certainly, customers bear certain risks related to a proposed transaction, though those risks are very different in nature. Shareholders bear the risk that a transaction looks like a good idea, but really is not, as anticipated value sources and financial results are not ultimately available.

Customers, on the other hand, need to count on utility management to ensure commitments and outcomes, such as full synergies are realized, and that the transaction does not turn out to be "a good idea, but couldn't be made to work."

However, the risks customers may bear are not equivalent to those borne by shareholders. First, the commitments agreed to by the combining companies set forth the parameters of regulatory expectations (such as financial conformance) to be met and are used by regulators to ensure adherence and performance.

Second, combining companies have committed to providing specific synergies levels to customers, thus guaranteeing provision. Third, utilities have a strong track record of attaining expected synergies levels, so real concern over performance is ameliorated. Finally, if unexpected events occur that adversely affect rate levels or financial capability, regulators have multiple levers before future rate cases to ensure customers are protected.

An adverse regulatory reaction at any stage of a transaction is undesirable to all stakeholders: shareholders, combining utilities, customers, communities, regulators, and intervenors. The solution is for utilities to clearly demonstrate to regulators the value ascribed to customers is real. But delivering fulsome benefits to customers without an equitable and time-synchronized synergies distribution and costs-to-achieve recovery method is confiscatory.

Part two of this article in December will explore the importance of a well-crafted regulatory plan.

The views expressed in this article are those of the authors and do not necessarily reflect the views of Ernst & Young LLP or other members of the global EY organization.

Category (Actual):

Department: