Maybe Steve Huntoon Was Right

Leonard Hyman is an economist and financial analyst specializing in the energy and regulated sectors. He was formerly head of utility equity research at Merrill Lynch, and senior advisor to investment banking at Salomon Smith Barney. At one point, he was on a NASA panel investigating the placement of nuclear power plants on the moon. He is author of America’s Electric Utilities: Past, Present and Future.

William Tilles is a senior industry advisor and speaker on energy and finance. He worked as a bond analyst and later headed equity utility research at Dean Witter Reynolds and then Smith Barney. He then became a portfolio manager at Angelo, Gordon & Co. and later at Sandell Asset Management. For a time he ran the largest long/short equity book in the world.

What do utility shareholders want? Answer: to earn a total return, dividends plus capital gains, at least commensurate with the risk incurred.

That is, to earn a return equal to, or in excess of, the cost of capital.

Did shareholders earn this in the past? And what do they require now?

In a recent piece written for Public Utilities Fortnightly, Steve Huntoon didn’t directly answer those questions. Rather he concluded, much more elegantly, that whatever shareholders want, they get too much of it.1

Steve is a lawyer. So what does he know?

The authors of this column spent years on Wall Street, complaining that regulators did not provide investors with adequate returns. So we decided to check out the numbers.

Understand first, the market determines cost of capital. Regulators don’t.

Second, to determine expected return, investors and academics have lately begun to rely more on historical data.

They are taking into account the tendency of markets to revert to the mean. We will try to apply that technique to answer the questions.

Let’s cut to the chase. In the past century or more, globally, common stocks earned real returns of about five and a half percent to six and a half percent. Per year. Adjusted for inflation.

In the U.S., return on stocks have exceeded return on risk-free Treasury bonds. The equity risk premium was roughly two-point-four to five percentage points.

Recent Federal Reserve Bank monetary policy makes Treasuries a dubious benchmark. So we will use seasoned Baa corporate bonds instead.

Those bonds offered yields of one to two percentage points more than Treasuries in the past. And two to three percentage points more recently.

We estimate that investors, over the long term, expect that corporate bonds will earn two percentage points over Treasuries. And equities will earn five percentage points over Treasuries.

For a rule of thumb, equities will earn about three percentage points over corporate bond yields. Why bother with a rate case? Just use that handy rule of thumb.

Two additional points. Bond yields track inflationary expectations. So our calculation in current dollars indirectly takes inflation into account.

Also, over the post war period, utility stocks have performed at least as well as industrial stocks. So conclusions derived from the general market probably apply to them as well.

The first question is, what did utility investors earn? And was that good enough?

In the postwar period, investors earned just less than ten percent per year. That’s six and a half percent in real terms.

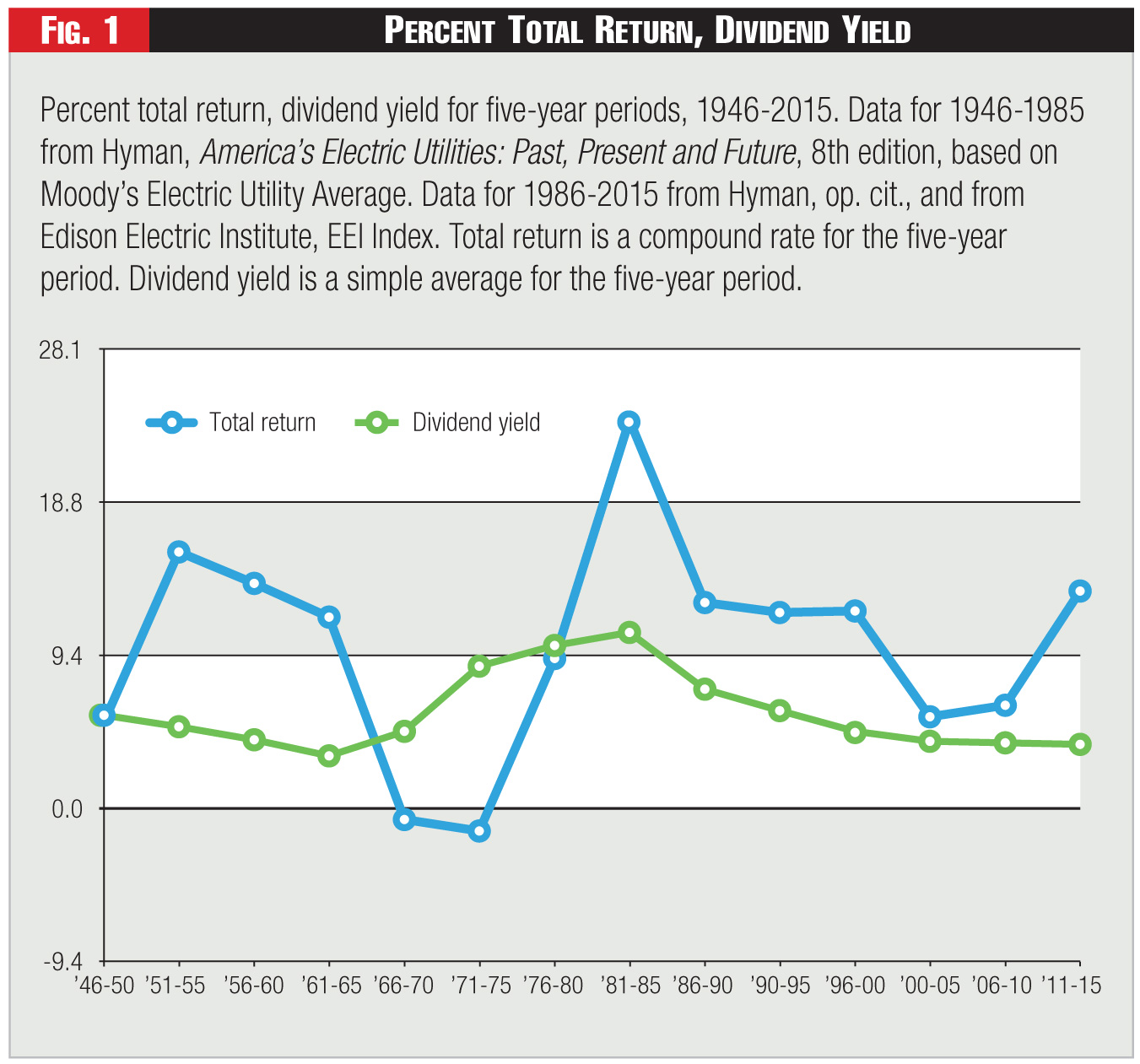

Dividends made up about sixty-three percent of this return. See Figure 1.

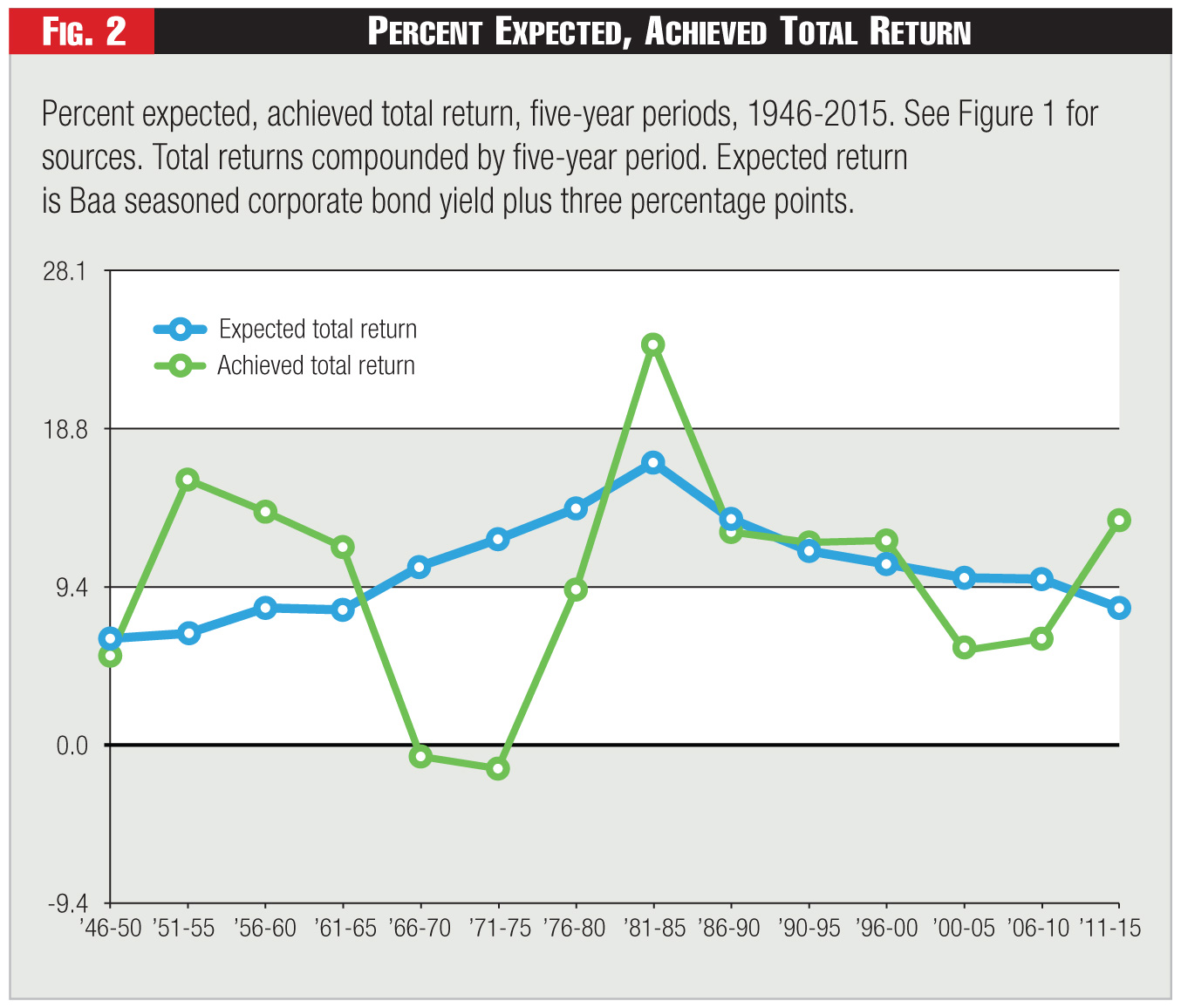

Our rough-and-ready formula calculated a required return of ten and a half percent per year. That’s six-point-nine percent in real terms. See Figure 2.

Utility stocks then earned in-line with long-term market expectations.

But utility stock prices exceeded their book value in fifty-six of the past seventy years. With sub-par pricing during energy and nuclear crises.

This indicates that utilities earned more than the cost of capital in most years.

Thus, utility investors earned an average market return, while taking a lower than average risk. Return probably exceeded the cost of capital.

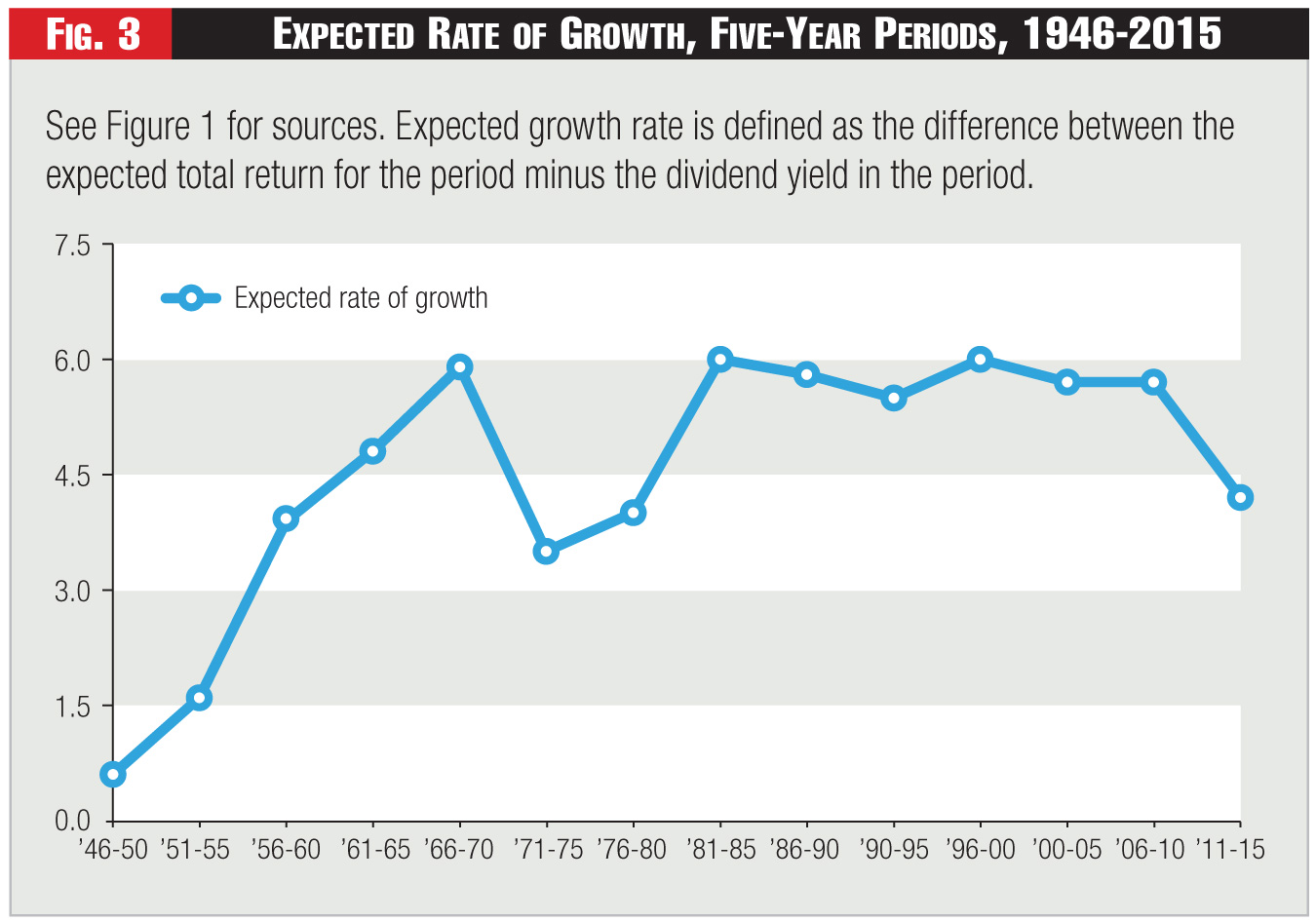

The numbers tell us about anticipated growth. We define this as expected total return, minus dividend yield.

Over the postwar period, we calculate that investors expected growth of about four and a half percent per year. See Figure 3.

At the end of June 2016, corporate bonds yielded four and a half percent. Utility stocks yielded three-point-four percent.

This indicates, based on historical precedent, that equity investors want a seven and a half percent annual return. Three-point-four percent from dividends. Four-point-one percent from capital gains.

Is seven and a half percent, the number implied by Steve Huntoon, the nominal cost of equity capital? Imagine using that level of return in a utility rate case.

Sooner or later, regulators may see the gap between allowed returns and cost of capital. They might reduce returns.

Or regulators could impose British-style incentive regulation. It would offer utilities the opportunity to take higher risks, in order to maintain returns.

Either option could endanger dividends. That is the downside.

Income-starved investors are looking for means to meet their long-term obligations. They may accept even lower returns than the cost of equity capital we calculated.

The trick is for utilities to find ways to utilize that pool of capital.

Investors just want a better return on a safe investment than the one and a half percent they can get on ten-year Treasuries. Both utilities and electricity consumers might benefit from this trying financial situation.

And yes, it looks as if Steve Huntoon was right after all. Even if he is a lawyer.

Endnotes:

1. Steve Huntoon, “Nice Work If You Can Get It,”Public Utilities Fortnightly, August 2016.

Robert D. Arnott and Peter L. Bernstein, “What Risk Premium Is Normal?” Financial Analysts Journal, March/April 2002, is a pioneering paper on the topic. It is comprehensive and comprehensible. For more recent data and analysis, see Martin Leibowitz, Andrew W. Lo, Robert C. Merton, Stephen A. Ross, and Jeremy Siegel, “Q Group Panel Discussion: Looking to the Future,” Financial Analysts Journal, July/August 2016.

Category (Actual):