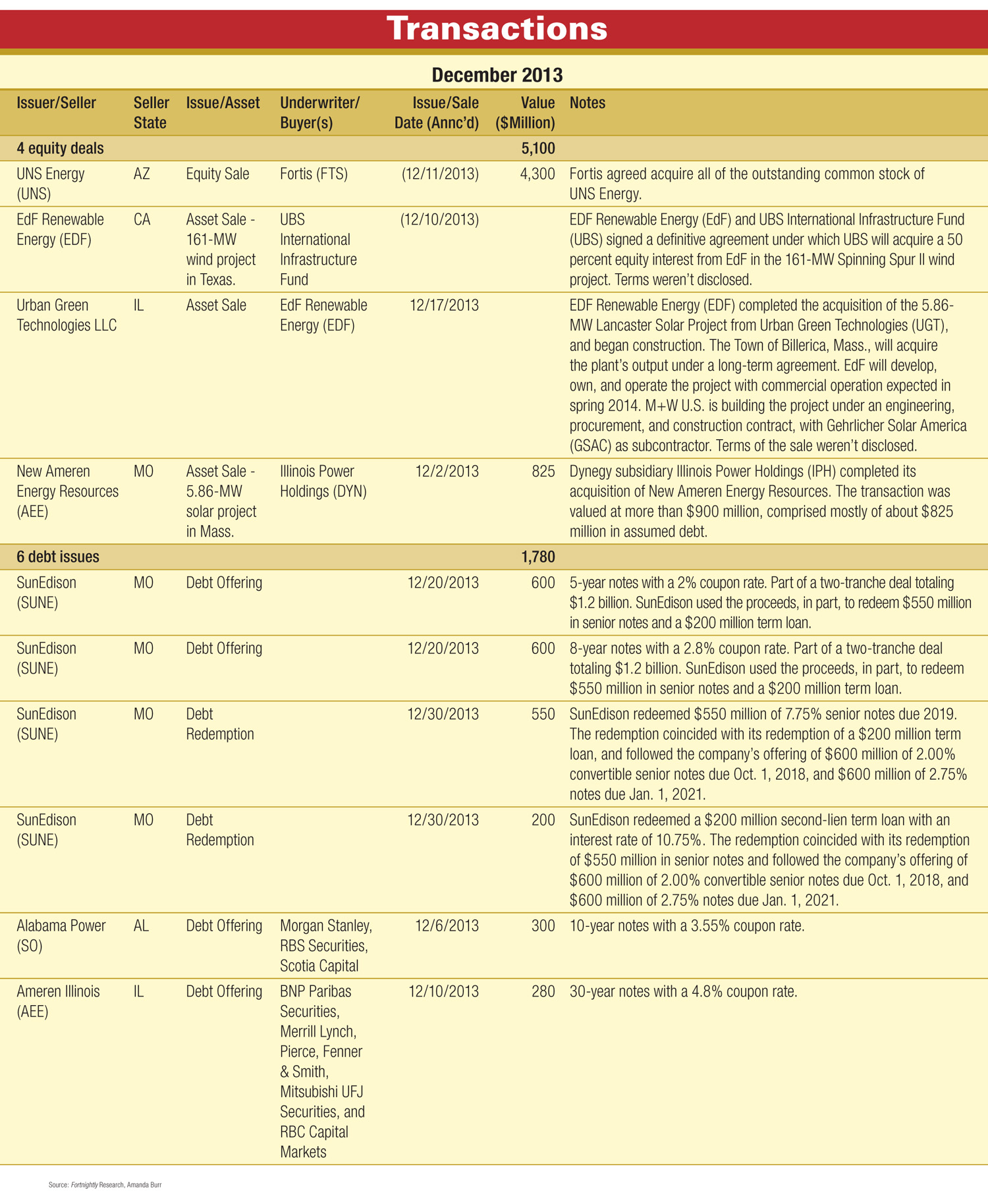

Fortis acquires UNS Energy for $4.3 billion; EdF sells half of Texas wind project to UBS; SunEdison sells $1.2 billion in bonds and redeems $750 million in debt; plus equity and debt transactions totaling nearly $7 billion.

Fortis acquires UNS Energy for $4.3 billion; EdF sells half of Texas wind project to UBS; SunEdison sells $1.2 billion in bonds and redeems $750 million in debt; plus equity and debt transactions totaling nearly $7 billion.

SCE&G acquires larger share of VC Summer nuclear project; APS buys SCE's share of Four Corners power plant; Allete (Minnesota Power) acquires from AES 231 MW of wind farms in four states; EdF acquires 194-MW Texas wind project; NRG issues $1.1 billion in bonds; ComEd floats $650 million in two tranches; plus transactions involving TransCanada, Alterra, PSEG, and others totaling $3.4 billion.

Calpine acquires Texas combined-cycle plant from MinnTex; FirstEnergy sells 11 hydro stations to LS Power; Alterra Power acquires 202-MW wind farm; plus deals and debt issues totaling $1.8 billion.

Sunrun acquires AEESolar and SnapNrack; FirstEnergy completes sale of hydroelectric power stations to Harbor Hydro Holdings; Alterra acquires Shannon wind project from Horn Wind.

Energen signs stock purchase to sell Alagasco to The Laclede Group; Calpine agrees to sell six power plants to LS Power; Exelon agrees to buy Pepco Holdings Inc.; GE offers to acquire power and grid businesses from Alstom.

Electric utility mergers loom as the next step in restructuring.

Mark C. Beyer

Mark C. Beyer is chief economist of the New Jersey Board of Public Utilities (NJ BPU). This article expresses his views and not necessarily those of the NJ BPU, its commissioners, or its staff.

Despite the cost advantages enjoyed by large producers, at present the electric utility delivery system resembles a "cottage industry," consisting of many relatively small firms. Mergers and acquisitions of electric utilities, in which smaller companies combine to form larger ones, have been noticeably lacking.

Yet under a true rationalization of the industry, mergers would be expected to play a role similar in effect to electric industry restructuring. Mergers would produce benefits in terms of more efficient and effective organizations, resulting in increased productivity and as a consequence lower prices. And given the large size of the electric utility industry, the macroeconomic gains could be substantial.

Why have we not seen more electric utility mergers?

In fact, the electric utility industry in the United States is comprised of a large number of relatively small firms most of which were formed years ago based on factors such as geographic boundaries, legal concerns or political considerations, but usually not based on economic efficiency. The graph labeled "Distribution of Investor-Owned Electric Utilities by Market Capitalization" (see Figure 1) will illustrate this fact. It is based on data from the Edison Electric Institute and includes data on United States based investor-owned utilities.

Figure 1 shows that approximately 45 percent of the companies have a market capitalization of between $1 billion and $5 billion. That's a size very much suitable for a merger or an acquisition by private equity or an infrastructure or sovereign wealth fund. Approximately 20 percent of the companies have a market capitalization between $10 billion and $20 billion - a size suitable for a merger of equals with another electric utility or an acquisition by an entity such as Berkshire Hathaway.

Even though not every company would be available to merge, the current structure of the electric industry (which is primarily comprised of relatively small firms) is not economically efficient. Given the large overall size of the electric utility industry, consolidation of the industry resulting in better resource allocation and lower prices for utility services has the potential to materially increase income, output and economic growth.1

There are two primary reasons for this lack of consolidation - why the industry has tended to maintain its current inefficient structure:

• The pricing mechanism, known as cost of service, which has prevailed in the industry for many years; and

• Regulatory protectionism, with effects similar to trade protectionism.

The first factor, cost-based regulation, sets prices based directly on the costs of the regulated firm. It is meant to produce prices that would exist in a properly functioning market. Rate of return regulation, the predominant form of cost-based regulation, establishes the return on equity a utility can earn.

Depending on the jurisdiction, the rate of return on equity can be used to set rates initially, as a cap with earnings above the cap returned or shared with ratepayers, or as a guarantee with rates adjusted upward if necessary to enable the company to earn the approved return. The objective is to ensure that prices are set at a level that allows the utility to provide service and invest appropriately in new facilities, but not so high as to allow excessive profits. A fair return on utility investment, although not guaranteed, is reasonably assured through the rate-making process. Cost-based pricing does not necessarily produce rates for utility services that are efficient, least cost, or beneficial to the consumer. Markets are much more efficient at allocating resources and determining prices; however, cost-of-service pricing limits their effectiveness.

The second factor is what we might term "regulatory protectionism." Regulatory and trade protectionism both refer to policies that restrict or restrain trade or competition, and thereby retain relatively inefficient producers in the market. The reasons for such protectionism may be varied, but they include a desire to retain local control, as well as a misunderstanding as to the benefits of creating more efficient companies (perhaps because the benefits are poorly explained by the merging companies).

While regulatory protectionism may appear beneficial in the short term, in the long run, such barriers are counter-productive. They create less efficient firms and retard productivity gains. Nevertheless, bigger utilities (e.g., Duke Energy) are more efficient and effective enterprises, just as Home Depot is a more efficient and effective enterprise than the local hardware store. Regulatory protectionism leads to higher prices plus an inefficient use of resources.

In recent years, approximately one-half of the states in the United States have adopted some level of deregulation or restructuring of the electric utility sector designed to enhance competition and eliminate inefficiencies in the supply market. The goal of restructuring was to increase competition in both wholesale and retail markets in order to reduce electric rates and expand consumer choice; consumers did not want to pay for excess capacity and utility inefficiency.

Utility generation was required either to be divested or transferred to an unregulated subsidiary. The cost of energy and capacity was eliminated from the retail rate such that retail suppliers could compete directly in supplying electricity to the consumer. Electricity would be bought or sold in the wholesale market either through an auction process or through bilateral contracts. In contrast to efforts to expand electricity supply options, transmission and distribution would continue to be regulated under traditional cost of service regulation.

Restructuring eliminated cost-of-service regulation in generation and replaced it with a system of prices and markets that allowed producers to keep the profits from efficiency gains in electricity generation. After all, cost-of-service pricing had imposed the majority of cost overruns on captive retail customers, providing few incentives for production efficiency or technological innovation. The economics of rate-regulated utilities are such that the larger the rate base, the greater the earnings and the higher the stock price. This regulatory paradigm tends to encourage excessive capital spending: utility earnings are determined largely by the size of the rate base, which does not encourage the efficient allocation of capital.

In contrast, if investments are made outside the utility, the incentive is to minimize costs, so as to maximize profits. The profit incentive resulted in a dramatic increase in capacity factors at existing coal and nuclear plants. The efficiency gains were especially pronounced at nuclear plants as can be seen in Figure 2.

Prices for utility services based on the low capacity factors that were commonplace prior to restructuring appeared reasonable and cost-based at that time, despite the fact that the prices are not reasonable when compared to the prices determined by producers operating in competitive markets. Prices determined by competitive markets are often much lower than prices thought to have been reasonable under regulation. Although restructuring has produced dramatic productivity increases in generation, similar productivity increases have not been realized in transmission and distribution.

Mergers of electric utilities can provide numerous benefits to both ratepayers and shareholders, similar to those that have come from industry restructuring. Mergers can create the large organizations with economies of scale that can provide utility services in an effective and efficient manner. New technologies such as smart grid and advanced renewables can save costs and create environmental benefits; yet producers need volume to spread the costs of these complex and expensive fixed assets.

That the benefits of the merger must exceeds the costs - including the cost any premiums paid by the acquiring company - underscores the need for effective execution of the merger plan to assure that all stakeholders benefit. Only an adroit management team can fully realize the synergies; it requires much more than simply combining two organizations and eliminating redundant costs. The lower cost structure provides additional funds for investment in rate base without an increase in prices, further increasing profitability and shareholder value.

Mergers of electric utilities can lead to significant cost savings through personnel reduction, purchasing efficiencies, administrative consolidation, reduction in corporate overhead, avoided capital expenditures, lower cost of capital, stronger credit profile and improved access to capital, and streamlining of data processing functions. In addition to cost savings, mergers may yield other important benefits, such as the acquisition of management, geographic and regulatory diversification, opportunities for growth in infrastructure investment, more resilient risk management, new products and services, acquisition of skills (i.e., nuclear and data processing expertise), better customer experience, returns to scale, etc. More importantly, over time, all of the factors of production can be adjusted to optimal scale, further reducing costs and improving the overall efficiency of the organization. (See Figure 3.)

In the longer run, large, highly efficient utilities will produce lower rates for consumers and higher returns for shareholders. Profitability and shareholder wealth increase relative to the status quo as inefficient firms are not rewarded in the market. The lower cost structure could be used to finance additional energy efficiency or renewable investments without raising electricity prices to the consumer. Conversely, small, parochial producers cannot produce either competitive rates for consumers or adequate returns for shareholders.

Mergers are most beneficial among distribution utilities and among vertically integrated (distribution and generation) companies that are subject to rate of return regulation. Mergers among companies with regulated distribution and unregulated generation are less beneficial. That's because investors value regulated assets at a higher multiple of earnings and because potential market power concerns factor into the regulatory decision-making process. In addition, competition has already led to greater efficiency in unregulated generation markets, reducing the potential for further savings.

Furthermore, inherent conflicts exist in a holding company structure that contains both a distribution utility charged with providing safe, adequate and proper service at a regulated return, and a generation company seeking to maximize profits in competitive markets. In this type of situation, investors can always seek to maximize profits through a merger where the unregulated generating affiliate is spun-off, sold or merged with another unregulated generation company. And that is true especially if the holding company contains diversified investments that also could be sold or spun-off. History shows that diversified investments traditionally produce substandard returns based on the axiom: it is hard enough to make money in a business you understand, but almost impossible to make money in a business that you don't. And even when diversified investments are successful, such success usually is not reflected in the price of a company's stock.

In addition, some financial observers believe that investors prefer "pure play" securities, such that shareholder value would be increased if there were separate distribution and generation companies, especially when the generation company operates in competitive markets. The thinking goes that traditional utility investors prefer the earnings stability associated with the ownership of regulated assets rather than the higher risk and higher return associated with competitive markets. In this view, merchant generation affiliated with utilities could be pulling down the valuation of the parent company, making it a propitious time to sell, merge or spin-off the unregulated generation.2

The need for regulatory approval may account for the lack of mergers, either by imposing costs, or causing utility management to shy away from certain deals if regulatory approval appears too difficult to obtain. Nevertheless, numerous mergers have been approved that preserved economic benefits for both ratepayers and investors.

Thus, the decision as to what degree of jurisdiction to exercise with respect to mergers ought to depend on the nature, scope and relative riskiness of the particular transaction and its impact on customers and other parties. The focus of the review should be to not micro-manage the affairs of the company or its affiliates, but to assure a fair allocation of the costs and benefits between ratepayers and shareholders.

Most jurisdictions require that the transaction must produce positive benefits, or else produce no harm. However, the difference between these two ideas - the positive benefits test versus the no-harm standard - appears to be more form than substance.

In both cases, cost/benefit analyses provide guidance as to the desirability of the proposed transaction. Under the positive benefits test, the expected benefits must exceed expected costs for the transaction to be approved, while under the no-harm standard the expected benefits can be equal to or exceed the expected costs for the transaction to be approved. In other words, only in the case where the expected benefits are equal to the expected costs do the two standards produce different conclusions. From a practical viewpoint, there is no significant difference between the positive benefits test and the no-harm standard. However, states that do not review and approve mergers frequently lose out by not having a seat at the bargaining table.

State commissions evaluate mergers based on statutory criteria such as the impact on (1) competition, (2) rates, (3) employees and (4) service quality. The evaluation process provides a forum for stakeholders such as employees, unions, public advocacy groups, ratepayers, environmental organizations as well as debt and equity investors to have input into the process, which leads to greater public confidence in the decisions that result.

Let's consider these four criteria in detail.

1. Impact on Competition. The concern here is to what extent a combined entity would have the ability to influence the market price of electricity. Market power refers to the ability of a firm to raise the price of electricity above levels that would prevail in a competitive market. Even a market distortion of one, two or five percent could cost consumers hundreds of millions of dollars for a large utility. Available evidence indicates that power markets are often less competitive post merger.

Whether a merger of utilities that own generation will raise market power issues depends on whether the generation assets are regulated. Market power is less of a concern in cases where electric utilities are vertically integrated and prices are based on rate of return regulation. If the generation assets are subject to cost of service regulation, the matter can normally be resolved with behavioral mitigation and consideration of future entry and exit. If the merger involves unregulated generation assets where the merged company will have a significant share of the market, such that market power could be exercised, expect considerable regulatory intervention including possible divestiture of assets. Market power would affect not only the price paid by merged companies' customers but also the customers of all other utilities which buy power in the wholesale power market.

Mergers that lead to higher electricity prices as a result of market power are generally difficult to get approved, even with significant concessions. A large increase in the price of electricity harms residential customers, particularly low-income consumers. Higher electricity prices weaken overall industrial competitiveness and retard economic growth; expect strong opposition from large power users. Horizontal mergers of distribution companies make the most economic sense and encounter the least regulatory resistance.

2. Impact on Rates. A merger should produce a reduction of costs at all levels of the company - particularly at the corporate level, where various departments such as investor relations and communications can be reduced or eliminated. These "synergy savings" are estimated by the company and its consultants, argued over with regulators, and ultimately split between ratepayers and shareholders with 50 to 75 percent going to ratepayers, presumably in the form of lower rates.

The goal is to develop a reasonable estimate and split such that the basic economics of the transaction remain intact. Unrealistically low estimates of merger savings are counter-productive to the approval process. So, too are assertions that all the savings will occur in the non-regulated portion of the business, and therefore cannot be passed along to ratepayers. Adroit management will estimate synergy savings and include such cost sharing in the initial pricing of the transaction.

Nevertheless, despite considerable regulatory scrutiny, company management skilled in integrating new companies frequently exceeds the initial estimates, which benefits the company only until the next base case, when rates are reset based on the cost of service. And it's important to note here that the reset rates tend to be lower than the rates would have been without the merger, thereby further benefiting the consumer. Incorporating regulatory incentives for efficient behavior and technological innovation into the rate setting process will help to ensure that the benefits from economies of scale are fully realized and reflected in the prices charged to customers.

An important related question is the mechanism by which the synergy savings are returned to ratepayers. An immediate bill credit has a high present-value cash cost without necessarily being appreciated by the recipients. Other uses of the synergy savings including new call centers in the service territory particularly if jobs are returned from offshore, enhanced severance packages for employees which are especially attractive to older workforces close to retirement, new office buildings or green energy projects, may have lower cash costs but higher public appeal. Any base rate cases should be filed and settled prior to the merger. A merger followed by a large base rate request will likely prove unsalable.

The rate impact issue usually includes a thorough review of multiple issues, such as (a) the financial management of the company, (b) money pool and ring fencing questions, in the case of a multi-jurisdictional holding company, and (c) dividend policy consistent with the maintenance of investment grade credit ratings, etc. All equity transactions preserve credit quality and the merged company can buy back stock at a later date depending on cash flow and credit metrics. Complicated transactions that only financial professionals can evaluate may receive a poor reception from individual investors.

3. Impact on Employees. Job reductions occur mostly at the corporate level, in such staff areas as personnel, investor relations, legal, corporate finance, etc. Line operations are much less impacted. Yet any loss of jobs, although unfortunate, is not likely to have a significant long-run negative impact on the state's economy. In the longer term, the benefits from lower-priced utility services contribute to regional economic growth far exceeding any initial loss of jobs.

Nevertheless, the review process does include determining potential job loss, and making sure the employees are treated fairly (and in the case of multi-jurisdictional mergers, that each state bears a proportionate share of the costs and benefits). Some mergers have been structured such that an extremely small minority of individuals becomes rich leaving other employees to defenestration. Such an approach assures that almost every employee, whether manager or craft, will be working against the transaction.

Other general areas of concern involve honoring union contracts, adequacy of pension funding and review of actuarial reports, and retention of adequate personnel to perform regulatory functions. It is strongly recommended that the acquirer retain existing regulatory personnel who possess knowledge that is difficult for outsiders to duplicate except over a long period of time.

4. Impact on Reliability. The maintenance and improvement of service quality is also generally considered in the context of the merger, especially with utilities experiencing service quality issues. Service quality encompasses such standard reliability measures as Customer Average Interruption Duration Index (CAIDI) and System Average Interruption Frequency Index (SAIFI) as well as OSHA based safety measures. Performance on such measures may be compared with other utilities, and the use of financial penalties and rewards may be considered. Additional regulatory oversight may be required to assure appropriate allocation of resources within the holding company structure.

The issue of reliability generally depends on the quality and reliability of service prior to the merger. And because many transactions involve holding companies with operations in multiple jurisdictions, those states that have a review process are better able to advocate for additional investment, service quality improvements and jobs. In the case of companies that already provide high-quality service, the concern lies with any possible future deterioration. In the case of companies with a poor record on reliability, a major selling point of the merger may be the improvement plan presented by the acquirer, which may include detailed engineering and financial commitments.

In all cases, the public must be assured there will be no deterioration in service quality. Call center performance is frequently considered in this context, as is restriction on the future location of call centers. The adequacy of financial and manpower resources dedicated to operations are also part of the review process.

The smart money should bet on a rise in mergers in the electric utility sector. And here's one key reason: the electric industry today shows parallels with other American industries that have lately seen their fair share of restructuring and consolidation.

The impetus for the change includes continuing pressure from deregulation, rising investor expectations, increasing capital requirements, declining allowed returns on equity, new entrants into the market, and slow revenue growth.3 The lack of revenue growth is the result of economic weakness, increased energy efficiency, net metering and falling natural gas prices.4 Some of these pressures are cyclical but others appear to be secular in nature. Even where there is no direct competition in the provision of services such as with distribution and transmission suppliers, competition among buyers which use those services as inputs in the production process creates pressure to reduce costs and lower prices.

Market forces and technological change have caused the consolidation and restructuring of numerous industries in the United States. IBM's hegemony was shattered by the personal computer while Digital Equipment, Prime, Wang and many other computer companies did not survive. Wal-Mart's efficiency in distribution produced a list of casualties in retail too numerous to mention. Large pharmaceutical companies have merged to maintain earnings growth because of patent expirations and a paucity of successful new drugs. The railroad industry has become much more efficient through restructuring and consolidation. The wireless telecommunications industry continues to consolidate as have the chemical and oil industries.

Increasing transparency and intense competition throughout the economy assure that high cost producers cannot survive when lower cost alternatives exist. Once profit margins decline and/or markets for products become commoditized, industry consolidation frequently results because only large, low cost producers can create shareholder value in low margin businesses.

For all these reasons, consolidation in the electric utility industry is inevitable as customers demand better products at lower prices. The continuing need to reduce costs, enhance competitiveness and increase shareholder value will lead to further industry consolidation despite cost of service pricing and regulatory protectionism. Electric utilities are characterized by low revenue growth; cost cutting and a low level of revenue generating investment do not produce significant earnings growth and stock price appreciation. Mergers can have a salutary impact on earnings growth, innovation, investment, rates and shareholder value as a result of economies of scale, better resource allocation and lower cost structure.

1. Developing a list of merger candidates is beyond the scope of this paper, however, a merger between Consolidated Edison, Inc. and Public Service Enterprise Group, Inc. would have the potential to produce synergy savings, lower rates and fund innovation in distribution and transmission which could produce extraordinary benefits for both ratepayers and shareholders.

2. This discussion is not meant to imply that merchant generation is an inferior business just that investors value the business based on different metrics, and that competitive businesses require different management and financial skills to maximize shareholder value.

3. Well capitalized new entrants such as Google or IBM in energy management or smart grid could negatively impact utility revenues while large, well capitalized entrants such as oil companies could invest downstream in generation which would erode energy and capacity revenues in merchant markets but could maximize the value of their gas assets.

4. The impact of low natural gas prices on merchant generation is important as even some nuclear plants are having trouble recovering fixed costs in markets where prices are determined based on marginal costs. In addition, low gas prices encourage distributed generation thereby depriving distribution utilities of revenue especially if combined with net metering.

- - -

Lead image © Can Stock Photo Inc. / javarman

Wisconsin Energy to acquire Integrys in a transaction valued at $9.1 billion; Dominion to acquire the CID Solar Project from EDF Renewable Energy; Landis+Gyr to acquire GRIDiant Corp.; PPL Corporation and Riverstone Holdings LLC to merge merchant power generation businesses into a new company Talen Energy Corporation; plus debt offerings totaling $1.5 billion.

PPL Corporation and Riverstone Holdings LLC announced a definitive agreement to combine their merchant power generation businesses into a new stand-alone, publicly traded independent power producer. The new company, which will own and operate 15,320 MW of generating capacity, will be called Talen Energy Corporation. Based on current generating capacity statistics, Talen Energy would be the third-largest investor-owned IPP in the nation. Under the terms of the agreement, at closing, PPL Corporation will spin off PPL Energy Supply, the parent company of PPL Generation, and PPL EnergyPlus, to shareowners of PPL and then immediately combine that business with Riverstone's generation business to form Talen Energy Corporation, an independent publicly traded company expected to be listed on the New York Stock Exchange. The transaction is subject to approval by the Nuclear Regulatory Commission, the Federal Energy Regulatory Commission and others.

Wisconsin Energy and Integrys Energy Group entered into a definitive agreement under which Wisconsin Energy will acquire Integrys in a transaction valued at $9.1 billion. Upon completion of the transaction, the combined company will be named WEC Energy Group, Inc. The combined entity is projected to have a regulated rate base of $16.8 billion in 2015, serve more than 4.3 million total gas and electric customers across Wisconsin, Illinois, Michigan and Minnesota, and operate nearly 71,000 miles of electric distribution lines and more than 44,000 miles of gas transmission and distribution lines. The combination brings together Wisconsin Energy's electric and gas utility (We Energies), plus a number of electric and gas utilities owned by Integrys (Wisconsin Public Service, Peoples Gas, North Shore Gas, Minnesota Energy Resources, and Michigan Gas Utilities).

Terra-Gen Power (Terra-Gen), an affiliate of ArcLight Capital Partners and Global Infrastructure Partners, signed a purchase and sale agreement with NRG Yield for the sale of its 947-MW Alta Wind I-V, X & XI, and Realty projects (Alta Wind). Terra-Gen expects to close the transaction in the third quarter of 2014, pending customary closing conditions, including the receipt of regulatory approval by FERC and the U.S. Department of Justice and the Federal Trade Commission. The sale of Alta Wind will divest Terra-Gen of its remaining phases of the Alta Wind Energy Center (AWEC). Terra-Gen originally acquired the AWEC development platform from Allco Finance in June 2008.

Dominion plans to acquire the CID Solar Project from EDF Renewable Energy (EDF RE). The asset sale agreement will close upon completion of installation, after which EDF RE will manage the commissioning and place the project in service. CID Solar Project, located on 200 acres of private land in eastern Kings County, California, was developed by EDF RE and is designed as a 27 MWp / 20 MWac ground-mount facility comprised of First Solar Series 3 solar photovoltaic modules with horizontal single-axis trackers. Construction commenced on June 12, 2014 with an anticipated date of operation in the fall 2014. The project's energy will be delivered to Pacific Gas and Electric under a 20-year PPA.

First Wind finalized seven 20-year PPAs with Rocky Mountain Power, a division of PacifiCorp. As part of the purchase agreements, Rocky Mountain Power will buy the output of the planned 20-MW Seven Sisters projects under its obligation from the federal Public Utility Regulatory Policies Act (PURPA). The Seven Sisters portfolio includes seven separate solar photovoltaic projects, four of which are to be sited in Beaver County and three to be located in Iron County, Utah. The start of major construction is slated to begin in late 2014 with a target completion date of July 2015.

Vista Solar completed a 118-kW high efficiency SunPower solar power system for national builder DPR Construction. The system, which was designed, engineered and installed by Vista Solar, is expected to generate at least 158,000 kW hours of energy each year. To generate the maximum amount of power within limited roof space, Vista Solar installed high-efficiency SunPower X21/345 solar panels. Additionally, Vista Solar installed Solar Edge inverters which pair DC optimizers with each panel to produce as much power as possible, as well as Silverback Solar racking for a custom design solution.

Seattle City Light, the Woodland Park Zoo and the Phinney Neighborhood Association (PNA) installed Washington state's largest community solar project to date. The Community Solar on Phinney Ridge project is designed for a 73 to 74 kW system on the roofs of two buildings at the zoo and PNA's Phinney Center. Anyone with a Seattle City Light account can purchase part of the array's output and the cost of which can be added to a participant's electric bill. Participants receive credit for their units' production on their City Light bills through June 30, 2020, along with all state renewable energy production incentives.

Petra Systems, along with its partner Caspian Renewable Energy, completed the installation of the largest smart solar power plant in the Middle East. The 5-MW project will be owned by Bahrain Petroleum Company (BAPCO), a wholly owned subsidiary of National Oil and Gas Authority (NOGA) and will deliver in excess of 8,000 MWh of renewable energy. Inaugurated June 25th at the Awali Township, the 5-MW BAPCO project marks the first phase of the 'Let Bahrain Shine' initiative, a consortium led initiative to assist the Kingdom of Bahrain meet up to 10% of its energy demands by 2010 through clean renewable energy.

First Solar received board approval from the Overseas Private Investment Corporation (OPIC), the U.S. Government's development finance institution, and IFC, a member of the World Bank Group, for financing to support construction of the 141-MW Luz del Norte solar power plant in Chile's Atacama Desert. The loans, which are expected to close late this summer, clear the way for First Solar to proceed with construction planning at the site. Terms of the deals were not disclosed. The OPIC board approved a loan of up to $230 million; the IFC board approved a $60 million loan.

First Wind finalized four 20-year PPAs with Rocky Mountain Power, a division of PacifiCorp and part of Berkshire Hathaway Energy. As part of the PPAs, Rocky Mountain Power will buy the output of the planned 320-MW Four Brothers solar development, which includes four 80-MW project sites. Rocky Mountain Power's purchase is made in connection with its obligation under the federal Public Utility Regulatory Policies Act (PURPA), and follows seven similar PURPA agreements for First Wind's 20-MW Seven Sisters projects. Once complete, the combined generating capacity of the four projects will be more than 800,000 MW-hours per year. Construction is slated to begin in 2015 with a target completion date in 2016.

Southern Research Institute completed the Southeastern Solar Research Center (SSRC), a facility to study solar PV systems. The facility will house numerous research efforts beginning with an EPRI project focused on solar PV system orientation, tracking and aging. The SSRC includes multiple configurations of photovoltaic solar panel arrays, microinverters and an advanced energy-monitoring system, including trackers that follow the sun throughout the day, as well as southwest-facing solar PV systems to evaluate the utilization of afternoon sun. The SSRC will be located on the campus of Southern Research Institute in Birmingham, Ala.

Landis+Gyr signed a definitive agreement to acquire GRIDiant Corporation, a utility analytics company focused on the electric distribution grid. GRIDiant's analytics suite will be integrated into Landis+Gyr's advanced metering infrastructure (AMI), distribution grid management and cloud-based solutions for utility customers. The influx of data from advanced metering, intelligent sensors and other distribution devices can challenge a utility's ability to utilize data for planning and operational performance. Landis+Gyr's advanced analytic offering will help correlate data collected from the smart grid network with other enterprise data to improve efficiency, streamline operations and facilitate a more rapid decision making process.

The U.S. Department of Energy (DOE) awarded The University of Texas at Austin a $12 million grant to fund carbon storage research aimed at reducing greenhouse gas emissions. The four-year DOE grant will fund a carbon storage research project at the university's Center for Frontiers of Subsurface Energy Security. This grant is a renewal of the department's five-year, $15.5 million research grant to the center in 2009. The goal of UT Austin's research is to improve geologic CO2 storage, especially from coal and natural gas used to generate electricity. A multidisciplinary team from the Cockrell School, UT Austin's Jackson School of Geosciences and Sandia National Laboratory in Albuquerque, New Mexico, will collaborate on the project.UT Austin's research project will begin this fall.

Abengoa, together with the National Renewable Energy Laboratory (NREL) and the Colorado School of Mines (CSM), has been selected by the US Department of Energy (DOE) to develop a new solar storage technology for thermo-electric plants. The program will last for two years and will require an investment of $1.76 million by the US Department of Energy. Abengoa will be responsible for leading the systems integration work and the technical-financial analysis, focusing on the commercial potential of this technology in future solar plant projects. This project is part of the SunShot Initiative carried out by the US Department of Energy, which seeks to promote innovation in order to make the cost of solar power more competitive.

Pacific Future Energy plans to build and operate the world's greenest refinery on British Columbia's north coast. The $10 billion refinery is being designed to be built in modules, each processing 200,000 barrels of bitumen per day. The bitumen will be converted into gasoline, diesel, kerosene and other distillates. When all of the project modules are complete, the facility will process up to 1,000,000 barrels per day, starting with the first phase of 200,000 barrels per day.

Tollgrade Communications partnered with DTE Energy in a Clinton Global Initiative (CGI) commitment to action for a comprehensive grid modernization project in Detroit that will roll out over the next three years. DTE Energy is deploying Tollgrade's LightHouse MV smart grid sensors and predictive grid analytics platform at key substations and feeders within its distribution network. With this CGI commitment, Tollgrade and DTE Energy are targeting to reduce nearly 500,000 customer outage minutes over the next three years in the DTE Energy service territory where Tollgrade's LightHouse system is deployed.

The Energy Department announced more than $10 million for projects to improve the reliability and resiliency of the U.S. electric grid and facilitate quick and effective response to grid conditions. This investment which includes six projects across five states - California, Hawaii, Missouri, North Carolina and Washington - will help further the deployment of advanced software that works with synchrophasor technology to better detect quickly-changing grid conditions and improve grid reliability. The six awards announced, subject to final negotiation, include: Pacific Gas & Electric ($2.9 million DOE investment; $3.9 million recipient cost-share), Quanta Technology ($998,920 DOE investment; $1 million recipient cost-share), Electric Power Group ($908,613 DOE investment; $931,788 recipient cost-share), Burns& McDonnell Engineering Company ($1.4 DOE investment; $1.5 million recipient cost-share), Hawaiian Electric Company ($500,000 DOE investment; $500,000 recipient cost-share), and Peak Reliability ($3.9 million DOE investment; $4.8 million recipient cost-share).

The government of Equatorial Guinea selected MAECI Solar, a division of Management and Economic Consulting, in collaboration with GE Power & Water and Princeton PowerSystems, to install a 5-MW solar microgrid system on Annobon Province, an island off Equatorial Guinea in west central Africa. The solar microgrid will feature 5-MW solar modules and system integration by MAECI, an energy management system and controls from Princeton Power Systems and energy storage from GE. The island-wide microgrid will provide reliable, predictable power, supply enough electricity to handle 100 percent of the island's current energy demand and be the largest self-sufficient solar project on the continent of Africa.

Itron and Milsoft integrated Itron's smart grid and AMI software and Milsoft's outage management system (OMS). This collaboration enhances Itron Total Grid, a combined managed services and smart grid offering, and expands capabilities for the public power sector. The integrated systems enable Milsoft's OMS to request data from all AMI meters from Itron's multi-commodity systems. Furthermore, Milsoft OMS, through MultiSpeak, can determine the communication status of Itron's meters. Itron's systems actively detect outages and restorations as they occur and pushes them immediately to Milsoft's OMS.

Florida Power & Light Company (FPL) plans to invest in long-term natural gas supplies, which the company believes will save customers money and keep fuel costs lower. FPL is partnering with PetroQuest Energy, to develop up to 38 natural gas production wells in the Woodford Shale region in southeastern Oklahoma. PetroQuest will oversee and operate those wells. FPL will receive a portion of the natural gas produced from each well for its use. As part of its petition, FPL asked the Florida Public Service Commission (PSC) to approve guidelines for future natural gas production projects to allow the company to take advantage of future natural gas investment opportunities.

The California Independent System Operator (ISO) and PacifiCorp announced that the Federal Energy Regulatory Commission (FERC) granted conditional acceptance of tariff amendments to expand the ISO's real-time energy scheduling market across multiple states in the Western Interconnection, for participation on a voluntary basis by balancing areas falling outside the ISO's control. The new market, known as the energy imbalance market (EIM), is expected to increase resource efficiency, reduce costs and more effectively use renewable and conventional resources. Under the EIM, the California ISO will automatically dispatch the best resources to meet immediate changes in energy demands. The scheduled EIM go live is set for October 1, 2014 (see, Docket No. ER14-1386, June 19, 2014, 147 FERC ¶61,231). In addition, Las Vegas-based NV Energy has applied with their state regulator to begin participation in the new market beginning in October 2015, and FERC has accepted an implementation agreement between NV Energy and the ISO (see, Docket No. ER14-11729, June 13, 2014, 147 FERC ¶61,200).

Duke Energy Progress agreed to purchase $1.2 billion of certain generating assets from North Carolina Eastern Municipal Power Agency; Acquisitions by PSEG Solar Source and SunEdison; Exelon will provide equity financing for 21 MW of Bloom Energy fuel cell projects; Debt issues from Calpine and NRG Yield Operating.

NextEra Energy Partners' Bluewater Wind Energy Center in Huron County, Ontario has begun commercial operation. The project is comprised of 37 turbines and is capable of generating up to 60-MW of electricity. The Bluewater Wind Energy Center is owned by Bluewater Wind, LP, an indirect subsidiary of NextEra Energy Canada Partners Holdings.

Siemens Energy secured an order for a total capacity of 36 MW in Nordfriesland, Germany to supply twelve direct-drive wind turbines, eleven model SWT-3.0-113 and one model SWT-3.0-101 turbine, for the Süderlügum publicly-operated wind farm. Siemens has also been contracted for a 20-year service and maintenance agreement. Süderlügum has the ability to utilize renewable energy sources during calm weather by the "Reactive Power at No Wind" technology from Siemens. This option enables the wind turbines to stabilize the alternating current power grid when no wind is blowing, by producing reactive power and feeding this power into the grid. Installation for the Süderlügum wind farm is scheduled for late 2014.

The city of Palmdale completed an aggregate 976-kW DC solar generation project. Located at Palmdale's Civic Center, DryTown Water Park and Marie Kerr Park, the system is designed to generate more than 1,580 MW-hours of electricity per year and meet nearly 70 percent of the electricity needs for the three sites. Constellation financed the project's development and will own and operate the system. Palmdale will purchase the electricity generated by the system at a fixed-rate through a 20-year purchased power agreement (PPA) with Constellation. The solar power arrays are comprised of approximately 3,200 PV panels.

EDF Renewable Energy's 61- MW Spinning Spur II Wind Project in Texas has reached commercial operation. Spinning Spur II commenced construction of 87 GE 1.85-MW, 87-meter rotor wind turbines 40 miles west of Amarillo in June 2013. The power is sold pursuant to an 11-year purchase agreement. The project is one of the first to feed into the new CREZ (Competitive Renewable Energy Zone) transmission infrastructure. EDF Renewable Services will provide long-term operations and maintenance for the facility, balance of plant, project oversight, and 24/7 remote monitoring from its NERC compliant operations control center (OCC).

The Department of Energy (DOE) took the first step toward issuing a $150 million loan guarantee to support the construction of the Cape Wind offshore wind project with a conditional commitment to Cape Wind Associates. If constructed, the project would be the first commercial-scale offshore wind facility in the U.S., with a capacity of more than 360 MW of clean energy off the coast of Cape Cod, Massachusetts. The proposed Cape Wind project would use 3.6-MW offshore wind turbines that would provide a majority of the electricity needed for Cape Cod, Nantucket and Martha's Vineyard. Under the proposed financing structure for the Cape Wind project, the DOE would be part of a group of public and private lenders.

SunEdison acquired the 156-MW Comanche Solar project from renewable energy developer Community Energy. SunEdison is partnered with Community Energy to complete the final development stage of the project by structuring the financing and providing procurement expertise for the project, following which SunEdison will manage the construction, operation, and maintenance of the solar power plant. Construction will begin in 2015 with commercial operation targeted for early 2016. The Comanche Solar project is one of the TerraForm Power call-right projects, whereby TerraForm has the option to purchase the project from SunEdison once it achieves commercial operation. Xcel Energy will purchase electricity generated from the solar PV power plant under a 25-year PPA with SunEdison. Once operational, the solar power plant will be managed by the SunEdison Renewable Operation Center (ROC).

SheerWind announced field tests of multiple turbines used in a row or series has even greater electrical power output. The INVELOX system, a new concept in wind power generation, is a large funnel that captures, concentrates, and accelerates wind before delivering it to turbines located at ground level. By placing 2 turbines in a series in an INVELOX system, power showed an increase of 1.7X when compared to single turbine. Multiple turbines in a single INVELOX tower means nearly zero operational downtime because maintenance can be done on one turbine while the other continues energy production.

The Keeyask Hydropower Limited Partnership (KHLP) broke ground on the 695-MW Keeyask Generating Station in northern Manitoba. The project is a collaborative effort between Manitoba Hydro and four Manitoba First Nations - Tataskweyak Cree Nation, War Lake First Nation, York Factory First Nation, and Fox Lake Cree Nation - working together as the KHLP. Manitoba Hydro provides administration and management services for KHLP and will own at least 75 percent of the equity of the partnership. The four First Nations together have the right to own up to 25 per cent of the partnership. The first generator unit in-service date is targeted for 2019 with all units being commissioned by 2020 at a total cost of $6.5 billion.

AEP Energy began installation of a 101-kW solar array on the roof of The Ohio State University's Student Life Recreation and Physical Activities Center (RPAC). AEP Energy will fund, build, own and operate the approximately 10,000-square-foot array, made up of 367 solar panels. The solar array is valued at approximately $400,000, and the electricity produced by the array - approximately 116,000 kWh annually - will be supplied to Ohio State at a rate of $.04 per kWh throughout the next eight years. After eight years, Ohio State and AEP Energy may opt to enter into a renewal agreement or allow the agreement to terminate.

New York Governor Andrew M. Cuomo awarded $3.3 million to seven research teams to develop technologies that add resiliency and efficiency to New York State's electric grid. The projects were awarded support from the New York State Energy Research and Development Authority's (NYSERDA) Electric Power Transmission and Distribution Smart Grid Program.

The funded projects include:

• Brookhaven National Laboratory ($250,000) - Using radar in real-time response for restoration of electric utility systems;

• Clarkson University ($381,000) - Design of a resilient underground microgrid;

• ClearGrid Innovations ($100,000) - Using computer vision to analyze pictures of electric distribution problems;

• Con Edison, ($2 million) - Demonstrating gridlink, a non-synchronous microgrid solution; Cornell University ($227,000) - Advanced microgrid integration with distributed energy resources;

• Lockheed Martin Mission Systems Training ($300,000) - Integrated aerial weather damage assessment system; and

• Rochester Institute of Technology ($78,000) - Microgrid solutions for improving economic and environmental cost and grid resilience.

The U.S. Court of Appeals for the District of Columbia Circuit has denied various petitions seeking review of Federal Energy Regulatory Commission (FERC) Order 1000, concluding that FERC had authority under the Federal Power Act to compel the various transmission sector reforms initiated by the Order.

Among other conclusions, the D.C. Circuit upheld FERC's authority to (1) remove Rights of First Refusal (ROFRs) from federal approved transmission tariffs, (2) require transmission providers to participate in regional planning to consider regional grid needs, (3) require such planning to include an ex ante allocation of costs of approved grid projects to project beneficiaries, and (4) require regional planning to consider transmission needs driven by public policy requirements, such as state laws or local ordinances.

The parties seeking review of FERC Order 1000 had included some 45 petitioners and 16 intervenors, including state regulatory agencies, electric transmission providers, regional transmission organizations (RTOs), and electric industry trade associations. (So. Caro. Pub. Serv. Auth. et al., No. 12-1232, Aug. 15, 2014.)

Six U.S. nuclear utilities have established a technical advisory board for the deployment of GAIA, AREVA's next generation pressurized water reactor (PWR) fuel assembly design. These six utilities - including Dominion, Duke Energy, Exelon and PSEG - share a common interest in ensuring the technical advancement and demonstration of the new design for the U.S. market. As part of this program, one of the utilities will operate a set of eight lead test assemblies starting in spring 2015. The GAIA fuel design provides utilities cost-savings through better thermal performance and increased tolerance to earthquakes.

CB&I awarded contract orders by Entergy Operations valued in excess of $100 million for project services related to implementation of Nuclear Regulatory Commission (NRC) ordered modifications and upgrades at multiple nuclear energy facilities throughout the U.S. Since the Fukushima Daiichi incident in 2011, the NRC has required U.S. nuclear plants to evaluate and upgrade equipment and safety plans to reduce the likelihood of damage from overheating and containment failure in the event of a complete loss of power.

Babcock & Wilcox Power Generation Group (B&W PGG) was awarded a contract to design and manufacture two coal-fired boilers to be installed in the Dominican Republic, at the Punta Catalina Power Plant, for Corporación Dominicana de Empresas Eléctricas Estatales (CDEEE).

The contract, booked in the second quarter of 2014, was awarded by Italian engineering and procurement contractor Tecnimont S.p.A, which is developing the project as part of a consortium which includes Tecnimont, Constructora Norberto Odebrecht S.A. and Ingeniera Estrella S.r.l. B&W PGG will supply two 360-MW boilers, coal pulverizers, air heaters, fans and structural steel for the plant. Project management and front-end engineering for the project are underway in B&W PGG's U.S. operations. The project is scheduled to be completed October 2017.

The Sacramento Municipal Utility District obtained a 50-year renewal to operate its hydroelectric projects on the upper American River. The utility operates 11 reservoirs and eight powerhouses, which generate 688 MW of electricity, representing about 15 percent of SMUD's annual power. Part of the new license from FERC calls for SMUD to make some changes. The utility will make several recreational upgrades to reservoirs and it will increase the volume of water it releases into streams.

Mitsubishi Heavy Industries (MHI) received an order for a world's largest post-combustion CO2 capture system for the enhanced oil recovery (EOR) project in Texas, which is primarily promoted by NRG Energy and JX Nippon Oil & Gas Exploration (JX Nippon) of Japan. The system will capture CO2 from flue gas from an existing coal-fired power generation plant and will have a CO2 capture capacity of 4,776 metric tons per day (mtpd). MHI received the CO2 capture system order from Petra Nova CCS, a special purpose company (SPC) of NRG and one of the companies implementing the project, through Mitsubishi Heavy Industries America (MHIA), a wholly owned subsidiary of MHI in the U.S. The system is slated for completion in the fourth quarter of 2016.

Minnesota Power, a utility division of ALLETE, reached a settlement agreement with the Environmental Protection Agency (EPA) and the Minnesota Pollution Control Agency that resolves alleged violations of the Clean Air Act. The agreement does not include any admission of wrongdoing on the part of the company. Minnesota Power is one of many utility companies in the U.S. whose investments in electric generation facilities were reviewed as part of the EPA's Coal-Fired Power Plant Enforcement Initiative that began in 1999. The initiative has resulted in more than 25 related settlements nationwide. Under the terms of the settlement, ALLETE will pay a $1.4 million civil penalty. In the second quarter of 2014, ALLETE recorded an after-tax expense of $2.5 million, or $0.06 per share, to reflect a liability associated with the conservation and clean energy projects.

Supported by the U.S. Agency for International Development (USAID), seven senior executives from the government of Haiti and Electricité d'Haïti participated in an executive exchange with their counterparts from Colombia's energy sector to review best practices in electricity sector reform and governance. The exchange, conducted by the U.S. Energy Association as part of its Haiti Energy Policy and Utility Partnership Program (HEPP), a two-year project conducted jointly with the government of Haiti and Electricité d'Haïti to encourage electricity sector reform, encourage private sector participation and investment, and make way for future generation capacity expansion.

Duke Energy Progress (Duke) and the North Carolina Eastern Municipal Power Agency (NCEMPA) approved an agreement for Duke to purchase the Power Agency's ownership in certain generating assets. NCEMPA currently maintains a partial ownership interest in several Duke Energy Progress plants, totaling approximately 700 MW, including: Brunswick Nuclear Plant Units 1 and 2, Mayo Plant, Roxboro Plant Unit 4 and the Harris Nuclear Plant. The purchase price for NCEMPA's ownership interest in the plants, including fuel inventories and spare parts inventory, is $1.2 billion, subject to certain adjustments as set forth in the asset purchase agreement (APA). Under the agreement, Duke Energy Progress and NCEMPA will enter into a 30-year wholesale power supply agreement.

PSEG Solar Source acquired the El Paso Solar Energy Center, a 13-MW solar energy facility near El Paso, TX, from juwi solar (JSI). The project was developed originally by JSI and has a 30-year PPA with El Paso Electric. The $22 million acquisition will increase PSEG's Solar Source's portfolio capacity to 106 MW. JSI is the EPC contractor for the project and will operate the project for PSEG Solar Source upon completion. Construction had commenced already and was expected to be completed by year's end.

SunEdison completed its acquisition of a 50% ownership stake in Silver Ridge Power (SRP) from a subsidiary of AES for approximately $178.6 million in cash. Through its ownership in the SRP joint venture, SunEdison now owns a 50% interest in 36-MW of solar power plant operating projects, including the 266-MW Mt. Signal solar project in California, and a 40% interest in the Tenaska Imperial Solar Energy Center West 183-MW solar power facility to be completed in 2016. The other 50% of the outstanding limited liability company interests of SRP remain held by an affiliate of Riverstone Holdings. SunEdison will provide operations and management (O&M) and asset management for SRP's entire projects portfolio.

ABB won an order worth approximately $400 million from NSP Maritime Link, a subsidiary of Emera, to supply a HVDC power transmission solution creating the first electricity link between the island of Newfoundland and the North American power grid. The Maritime Link Project is a 500-MW HVDC connection that will deploy ABB's HVDC Light Voltage Source Conversion (VSC) technology incorporating a full VSC bipolar configuration to further enhance system availability. In addition to the two converter stations for the ±200 kV HVDC link, the project scope also includes two 230 kV AC substations in Newfoundland, one 345 kV AC substation in Nova Scotia and two cable transition stations. The project is scheduled for commissioning in 2017.

ABB also won an order worth $78 million from Saudi Electricity Company (SEC), Saudi Arabia's national power transmission and distribution operator. ABB will supply transformers for two new combined-cycle power plants that will boost transmission capacity around the capital, Riyadh, and surrounding areas of the central region. ABB will deliver generator step-up (GSU) transformers, power transformers and station service transformers for SEC's combined-cycle power plants. The order was booked in the second quarter of this year.

AMSC, a global energy solutions provider, entered an agreement with ComEd to develop a deployment plan for AMSC's high temperature superconductor technology to build a superconducting cable system that will strengthen Chicago's electric grid. The Resilient Electric Grid (REG) effort is part of work underway by the Science and Technology Directorate of the U.S. Department of Homeland Security (DHS) to secure the nation's electric power grids and improve resiliency against extreme weather, acts of terrorism, or other catastrophic events. The Resilient Electric Grid is a self-healing solution that provides resiliency in the event that portions of the grid are lost for any reason. The ComEd installation would be the first commercial application of this technology in the United States.

Renewable Energy

Xcel Energy, the EPA, and the Colorado State Land Board joined community solar developer Clean Energy Collective (CEC) to officially open Denver County's newest community solar facilities - two 500-kW solar arrays in Denver County. Developed on a 5-acre site at the Evie Garrett Dennis School campus in northeast Denver, the two medium-scale solar PV arrays, consisting of more than 4,000 panels, are the eighth and ninth arrays CEC has brought online as part of Xcel Energy's Solar Rewards Communities program. Through the community solar model, any Xcel Energy ratepayer in Denver County can purchase individual panels in the shared arrays, from one kW up to enough panels to off-set all of their electricity needs.

SunEdison and BlueWave Capital completed a 1.8-MW solar power plant constructed on a remediated EPA Superfund site in New Bedford, Massachusetts. The City of New Bedford is the owner and host of the site and will purchase the net metering credits generated from the system. SunEdison partnered with BlueWave Capital to develop the project, arranged construction financing and permanent financing for the project, and managed local partners to provide EPC services. In addition to owning and hosting the site, the City of New Bedford signed a 20-year net credit purchasing agreement with SunEdison.

ReneSola Ltd will develop a 13-MW solar project in Dorset, England and expects the solar farm to be fully operational and connected to the national energy grid by end of 2014. The company has identified a number of potential buyers for the project, which received planning consent in January 2014 and is eligible for the United Kingdom's support scheme to promote renewable electricity-generating technologies. The project will feature ReneSola PV modules exclusively, specifically the Virtus II.

Duke Energy committed $500 million to a major expansion of solar power in North Carolina. The company will acquire and construct three solar facilities - totaling 128 MW of capacity - including the largest solar PV facility east of the Mississippi River. Duke Energy also signed PPAs with five new solar projects in the state, representing 150 MW of capacity. Together, the eight projects will have a capacity of 278 MW. Duke Energy will own the following projects: 65 MW - Warsaw Solar Facility (developed by Strata Solar); 40 MW - Elm City Solar Facility (developed by HelioSage Energy); 23 MW - Fayetteville Solar Facility (developed by Tangent Energy Solutions). Duke Energy will purchase power from these new projects: 48 MW - Bladen County (developed by Innovative Solar Systems); 48 MW - Richmond County (developed by FLS Energy); 20 MW -Scotland County (developed by Birdseye Renewable Energy); 19 MW - Cleveland County (developed by Birdseye Renewable Energy); 15 MW - Beaufort County (developed by Element Power US).

Duke Energy Renewables will build, own and operate a 110-MW wind power project, Los Vientos V, in Starr County, Texas. Garland Power & Light, Greenville Electric Utility System and Bryan Texas Utilities (BTU) have signed 25-year PPAs produced by the project. Vestas will supply 55 2-MW turbines for the project. The project is expected to be completed in late 2015.

Google agreed to provide $145 million in equity financing for the Regulus, SunEdison's largest developed and constructed project in North America. Located in Kern County, Calif., the Regulus plant will begin operation later this year, and will supply power to Southern CaliforniaEdison through a 20-year PPA. SunEdison developed, designed, executed the structured financing and is constructing the Regulus project, which was contributed to TerraForm Power. The 737-acre 82-MW DC solar PV power plant will be comprised of over 248,000 SunEdison mono-crystalline solar PV modules. This agreement represents the 17th renewable energy investment project for Google.

AWS Truepower was hired to act as independent engineer to support the financing and construction of the Ventika I & Ventika II wind projects in Nuevo Leon, Mexico. The Ventika Wind Project consists of two 126-MW wind projects, for a total capacity of 252 MW, making it the largest wind project in Mexico at the time of financing. The total investment for the projects is $650 million, secured by co-developers CEMEX and Fisterra Energy. AWS Truepower acted as the energy consultant and engineer in the debt financing for the project, and is providing construction monitoring on behalf of the lenders and project sponsors through to substantial completion of the projects, expected in the second quarter of 2016. The Ventika I and Ventika II projects will utilize 84 Acciona AW 3000 wind turbines. Construction began in the second quarter of 2014 and commercial operation is expected by the second quarter of 2016.

PPL Montana has agreed to sell its hydroelectric facilities to NorthWestern Energy. Montana Public Service Commission voted to prepare an order approving NorthWestern Energy's request to purchase the facilities. The agreement includes PPL Montana's 11 hydroelectric power plants, which have a combined generating capacity of more than 630 MW, as well as the company's Hebgen Lake reservoir. PPL The purchase price for the hydroelectric generating facilities is $900 million in cash, subject to certain adjustments.

Sweden's Electrolux AB paid $3.3 billion in cash for General Electric's appliances business. GE's century-old household appliance business could help the Swedish company expand beyond its core European market, where growth has trailed that in North America. The deal will be financed by a bridge facility, and the company plans a rights issue to raise about 25 percent of the price after the deal's expected closing next year. General Electric put the profitable but low-margin appliance business up for sale in 2008, but talks fizzled out as the global recession took hold.

Dominion acquired two solar energy projects totaling 42 MW from EDF Renewable Energy. The acquisitions of the California projects are expected to close in 2015. The 24-MW Cottonwood project, with solar sites located in Kings, Kern and Marin Counties, has secured a 25-year PPA, interconnection agreements and will come online in the first half of 2015. The Catalina Solar 2 project, located in Kern County, has secured a 20-year PPA, an interconnection agreement and an EPC contract. The 18-MW solar energy facility is expected to enter service in the second quarter of 2015.

Bourne Energy successfully field-tested the latest version of its BackPack Power Plant (BPP) portable hydropower system in a shallow remote river in the Pacific Northwest. The BPP device - a zero-fuel power generator (one cubic meter) producing 600 W - brings locally sourced, energy dense and 24/7/365 electricity to applications never before considered for renewable power systems, such as improving overall power efficiencies for fossil fuel plants and reducing power costs for biofuel production.

Itron was selected by ERDF (Électricité Réseau Distribution France), which serves as the electricity distribution network operator in France and distribution subsidiary of the Electricité de France Group (EDF), for its Linky smart grid program. Itron will be a major supplier of Linky smart meters for the first phase of the program. The Linky project aims to improve the distribution of electricity in France with an intelligent metering and communications network. In total, ERDF will replace 35 million meters, meeting the EU directive for 80 percent of meters to be smart by 2020. With this contract, Itron will supply from 1.2 million up to 1.6 million of the Linky smart meters to be deployed by ERDF for the first phase of the program. Itron will deliver the meters from September 2015 through the end of 2016.

Siemens received an order for the turnkey delivery of the grid connection for the Dudgeon offshore wind farm. The customers are the Norwegian Utilities Statoil and Statkraft, which are jointly implementing the wind farm off the coast of the U.K. Siemens will supply the entire power transmission system, including the two transformer substations - one onshore and one offshore - for the 402-MW project. Siemens had previously received an order in August to deliver 67 wind turbines in the new 6-MW class as well as to maintain the wind farm. The grid connection is scheduled to be completed by the end of 2016, and the installation of the wind turbines is expected to begin in early 2017.

ABB won an order worth over $30 million from Public Service Electric & Gas (PSE&G) to supply gas-insulated switchgear (GIS) for substations to boost the reliability of transmission infrastructure in New Jersey. ABB's order includes design, supply and commissioning of ABB's 550 kV GIS type ELK-3, a compact and modular solution. PSE&G is spending $4 billion between 2014 and 2016 to upgrade its electricity infrastructure to meet demand for electricity.

The U.S. Department of Energy, National Energy Technology Laboratory selected a team led by Burr Energy LLC (dba Microgrid Institute) to design, simulate, and test microgrid control systems for two Maryland suburbs served by utility Pepco Holdings. DOE/NETL is expected to provide approximately $1.2 million in funding assistance for the Olney Town Center Microgrid Project during a two-year period beginning in late 2014. The project team - including Microgrid Institute, Green Energy, Schneider Electric, and FREEDM SystemsCenter at N.C. State University, with assistance and cooperation from Pepco Holdings - will design, simulate, and test advanced control systems for community microgrids at Olney and Ritchie Station Marketplace. In addition to modeling a microgrid control system for the Olney Town Center area, the project also will design and simulate a community microgrid centered on the Ritchie Station Marketplace, a multi-use commercial development near the Washington, D.C. beltway.

ComEd, in partnership with Silver Spring Networks and Accenture, hosted its SmartGridExchange Forum, bringing together leading technology and innovation companies, including Oracle, NestLabs, Home Depot, GE Energy, and the Energy Foundry, with other customer and stakeholder organizations, including the City of Chicago, Citizens Utility Board and Smart Grid Consumer Collaborative, to discuss how to leverage the smart grid to deliver increased value to consumers. Forum discussions highlighted the need to build a customer energy ecosystem that will allow businesses to develop new energy products and solutions, and allow utilities to enable this innovation.

The Southwest Power Pool (SPP) has asked to revise its membership agreement to admit three new transmission-owning members: (1) the Upper Great Plains Region (Western-UGP) of the Western Area Power Administration, which operates as a federal PMA (power marketing administration), along with (2) Basin Electric Power Co-op, and (3) Heartland Consumers Power District, a political subdivision of the state of South Dakota, identified in the proposal as the "Integrated Systems," or "IS Parties." The deal as proposed would mark a substantial territorial expansion for SPP, building out its footprint to extend all the way North to the Canadian border, and bringing under SPP operational control some 9500 miles of transmission lines, rated 115kV to 345kV, stretching across a seven-state region, including a large swath of northeastern Montana, small parts of Wyoming, Nebraska, Iowa, and Minnesota, and extending across nearly all of North and South Dakota. If approved by the Federal Energy Regulatory Commission, the move would extend SPP operations into the Western Interconnection. (See FERC Dkt. Nos. ER14-2850, & 2851, filed Sept. 11, 2014.)

In the wake of the D.C. Circuit's controversial ruling in EPSA v. FERC, which overturned FERC Order 745 on how much to pay to suppliers for bidding demand response into energy markets, and which declared demand response to be outside of FERC jurisdiction, the PJM Interconnection has issued an informal white paper throwing out ideas on how it might re-imagine the way in which market participants might bid demand response into the region's capacity market, known as the Reliability Pricing Model, or RPM. The white paper, issued on October 6, 2014 ("The Evolution of Demand Response in the PJM Wholesale Market"), attempts to circumvent the court's ruling by redefining demand response not as a "resource," but as a commitment to curtail, which would be offered by a load-serving entity. PJM then would treat demand response as a reduction in the LSE's capacity obligation, so that a demand response bid in an RPM base residual auction that clears the market would be modeled as having shifted to the left (reducing the quantity term) the RPM's downward-sloping demand curve, otherwise known as the VRR Curve (Variable Resource Requirement). In a press conference held the same day of the release, PJM General Counsel Vince Duane described the initiative not as a formal proposal, but as a sort of thought experiment, floated to guage stakeholder reaction.

NRG Energy acquired Pure Energies Group, a residential solar industry provider; Duke Energy Progress filed with FERC for approval to purchase the North Carolina Eastern Municipal Power Agency’s generating assets for $1.2 billion; Trina Solar Limited signed a share purchase agreement to sell a power plant to funds managed by Foresight Group LLP; AES entered into an agreement to sell its 49.62% equity interest in a joint venture in Turkey; Southern Power acquired the 150-MW Solar Gen 2 solar facility in California from First Solar; SolarCity is planning to launch what would be the first registered public offering of solar bonds in the US; and debt offerings from Dynegy and ComEd.

SunEdison and TerraForm Power agreed to acquire First Wind for $2.4 billion; Emera will sell its 49% interest in Northeast Wind Partners II to First Wind for $223.3 million; Calpine completed its acquisition of Fore River Energy Center from Exelon for $530 million; NorthWestern Energy closed its $900 million purchase of 11 hydroelectric facilities and one storage reservoir from PPL Montana; juwi solar sold ownership interests in a 50-MW solar facility to Dominion; Dominion acquired a 20-MW solar facility from Canadian Solar.

juwi solar (JSI) sold ownership interests in a 50-MW solar energy facility to Dominion. The project was fully developed by JSI and claims a 20-year purchased power agreement with PacifiCorp. Currently named "Pavant Solar," the project will be located in Millard County, Utah on approximately 419 acres of private ranchlands that have been leased to the project. JSI is the EPC contractor for the project and will operate the project for Dominion upon completion. Construction will commence before the end of the year and is expected to be completed by the second half of 2015.

Dominion acquired West Antelope Solar Park, a 20-MW solar energy facility, from Canadian Solar with a 20-year PPA in place. With the addition of West Antelope Solar Park, Dominion has 344 MW of solar generating capacity - about 220 MW of which are in California - in development, under construction or in operation across six states. The company's renewable portfolio also includes approximately 850 MW of capacity generated by biomass, water and wind.

The U.S. Federal Energy Regulatory Commission (FERC) approved the proposed merger of Exelon and Pepco Holdings. The companies announced their proposed merger on April 30. (Docket No. EC14-96, Nov. 20, 2014, at 146 FERC ¶61,148.) The combination of the companies will bring together Exelon's three electric and gas utilities - BGE, ComEd and PECO - with three retail utilities owned by Pepco Holdings (PHI) - Atlantic City Electric, Pepco, and Delmarva Power and Light - to create the leading mid-Atlantic electric and gas utility. The companies anticipate completing the merger in the second or third quarter of 2015.

SunEdison and TerraForm Power signed a definitive agreement to acquire First Wind for $2.4 billion. SunEdison will purchase over 1.6 GW of pipeline and backlog projects, which have been added to TerraForm Power's call right project list and are expected to be operational in 2016-2017. Included in the transaction is an additional 6.4 GW of project development opportunities.

Montana-Dakota Utilities, a division of MDU Resources Group, signed an agreement to purchase a North Dakota wind farm to be developed by ALLETE Clean Energy. The wind project, located near Hettinger, N.D., and comprised of 43 turbines producing 107.5 MW of electricity, is anticipated to be completed in December 2015. The project's cost is approximately $200 million and the purchase is subject to regulatory approvals.

Calpine completed the acquisition of Fore River Energy Center, a natural gas-fired, combined-cycle power plant located in North Weymouth, Massachusetts. Calpine purchased the 809-MW plant from Exelon for $530 million plus adjustments, or approximately $655 per kW. Built in 2003, the Fore River Energy Center features two combustion turbines, two heat recovery steam generators and one steam turbine. All of Fore River's energy, capacity and ancillary services are sold into the competitive wholesale power markets.

Emera will sell its 49 percent interest in Northeast Wind Partners II (Northeast Wind), to its 51 percent partner, First Wind Holdings (First Wind) for $223.3 million. Northeast Wind owns and operates a 419-MW portfolio of wind generating assets located in the Northeast United States. Emera acquired its interest in Northeast Wind in 2012. Emera's sale is part of a larger deal that will see 100% of First Wind sold to a third party, and is conditional on that transaction closing. Both transactions are targeted to close in Q1, 2015, subject to regulatory approvals.