Flipping the Script on the Past

Thomas Flaherty III is a senior advisor to EY-Parthenon, Ernst & Young LLP. Mile Milisavljevic is a Partner in EY-Parthenon, Ernst & Young LLP. Jeffrey Miller leads the EY Americas Power & Utilities Strategy practice.

The drought in utilities sector mergers and acquisitions (M&A) is unlikely to continue much longer: there's too much interest in the value such transactions can unlock. As interest rates eventually decline, balance sheets become more durable, cash flows stabilize, stock valuations converge, and lower premiums emerge for mergers of equals, M&A in utilities will be primed to return as a conventional means of creating shareholder value.

The U.S utilities industry has a long history of consolidation, spanning over one hundred thirty years. Formative consolidation started with the purpose of knitting together regionally and nationally disparate groupings of more than six thousand localized utilities into multilayer holding companies.

From the early 1900s to the 1920s, this financial conglomeration resulted in massive consolidation of complex cross holdings. These structures led to financial abuses that made national headlines and captured the interest of federal lawmakers. The result was the passage of the Public Utility Holding Company Act of 1935 and the restructuring and streamlining of the holding company model.

Fast-forward to today, when U.S. utilities are assessing how much growth can come from sustained capital investment, cost management, and balance sheet strengthening (and for how long) compared with what can be created through inorganic means — whether through portfolio rationalization or traditional M&A. Unlike earlier eras, consolidation considerations will be more intentional, consequential, and more consistent in rationale and structure.

Today's reoriented view of M&A is predicated on several of these fundamental influences. This foundation is based on value — how it is preserved, where it is captured and how it is sustainably grown. The coming inorganic moves by companies will be directed at unlocking the value of scale that has been elusive to many utilities.

Next-stage M&A will embrace company priorities to build scalable and portable platforms that can optimize business segments and the enterprise. In this future, utilities will not just seek to build value from new sources; they will capture the benefits that inure from greater scale: a stronger balance sheet, more flexible financing, higher market values, and the increased strategic confidence to thrive in a more competitive and disruptive environment.

Where We Are Today

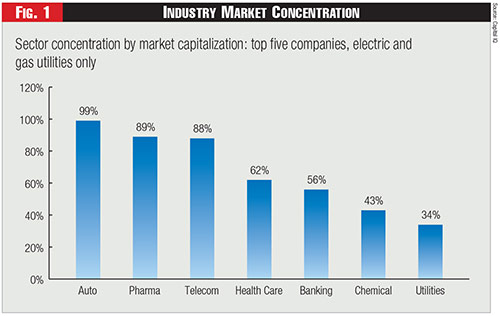

Most observers don't recognize it, but the utilities sector may be the leading consolidator among U.S. industries since the late nineteenth century. But compared with other sectors, and despite past restructuring, utilities are far less concentrated than other industry verticals. Banking, telecom, healthcare, auto, chemicals, and pharmaceuticals are all more heavily concentrated within tight groups of primary competitors.

The five largest U.S. utilities account for thirty-four percent of market capitalization sector-wide; in most of these other industries, the top five companies constitute between fifty-five percent and ninety percent in absolute scale.

See Figure 1.

The potential remains for additional and sustained consolidation in the sector, even as the number of utilities has dramatically contracted from approximately one hundred fifty in 1995 to fifty publicly tradable entities today, as tracked by S&P Capital IQ. Even with significantly fewer players, observers see the likelihood of major consolidation as policy adoption, capital investment, environmental mandates, financial risks, power adequacy, customer affordability, and regulatory requirements further shape sector action and response.

Conventional wisdom suggests it takes celestial alignment for M&A between utilities to come to fruition. Mergers of utilities tend to occur when an exceptionally financially strong company can monetize its position, a marginally financially secure entity relinquishes its independence, or shared alignment allows utilities to forge a stronger combined enterprise.

According to S&P Capital IQ, almost seventy stock-for-stock utilities mergers have been executed since 1995, with most of the transactions occurring between 1995 to 2001 and continuing through 2018, excluding recessions and COVID-19 pandemic. The most recent utility-to-utility corporate stock acquisition announcement occurred in 2020 but was terminated this year after a three-year inability to close.

State regulatory commissions can be demanding in how they evaluate proposed mergers, such as by applying the public interest standard and distributing net synergy benefits (after costs-to-achieve) between customers and shareholders.

Yet, most of these transactions received an equitable decision, with net synergies (potentially eight percent to ten percent of combined non-fuel O&M) nearly equally split between these stakeholders. And they closed in eight to nine months on average, much faster than the typical eighteen to twenty months of earlier periods.

These transaction outcomes depend on planning foresight, negotiating rigor, and execution prowess over a multiyear process. While synergies are tangible, measurable, and near-term, other benefits, such as long-term shareholder value, are less discernable as many uncontrollable factors can affect post-close business performance.

Whether shareholders can receive commensurate benefits from net synergies for the nature and level of risks they incur through and after merger conception, valuation, regulatory scrutiny, and post-close integration is an interesting proposition — but not as fascinating as the reason for companies' general inability to realize the value of scale.

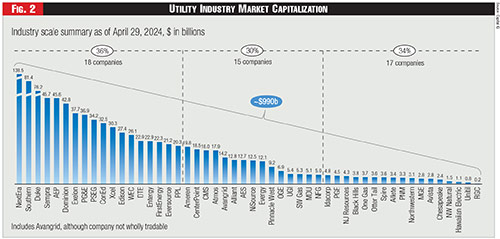

In mid-2024, three distinct U.S. utility segments exist: above twenty billion dollars, between five billion and twenty billion, and below five billion — with a similar number of companies in each. Total utility sector market capitalization is slightly under one trillion dollars, an increase of roughly seven hundred billion or three hundred fifty percent from 1995.

See Figure 2.

Utilities continue to wrestle with how to succeed in a less predictable market environment than existed a few short years ago. It is one typified by inconsistent economic signals, burgeoning electricity demand, higher carbon emissions, and stricter regulation. This has led companies to employ a blend of solutions to address future growth, portfolio contribution, cash flow, financial stability, and value position hurdles.

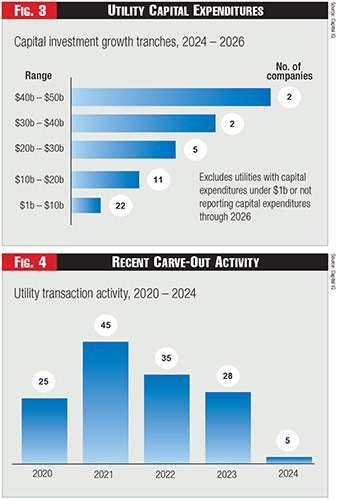

Recent earnings reports show capital expenditure plans for 2024 to 2026, with nine utilities set to spend over twenty billion dollars and eleven others more than ten billion. This follows a period (2014 to 2023) when cumulative electric and natural gas capital expenditures totaled over one trillion dollars, with the preponderance of spend outside the traditional area of power generation.

See Figure 3.

Yet the path to sustained capital investment has its own challenges, as balance sheet strength is uneven across the industry and cash flow generation is close to negative one hundred billion dollars annually. Neither broad capital investment across service territory and business ownership are always a virtue nor inevitably translate to commensurate earnings and returns. Consequently, utilities need to continue to tone up their balance sheets through steady retooling to enable themselves to pursue M&A to provide the strength and scale to thrive in an increasing-cost environment.

The investment community views enterprise congruence as an attractive business model since it focuses management on business simplification. U.S. utilities have been rationalizing their overall portfolios of assets, territories, and business segments over the last several years. Utilities have found carve-outs — sales, sell-downs, splits, or spins — to be partly driven by necessity, as existing funds from operations levels have fallen, resulting in too many companies near or below rating agency debt-ratio targets of thirteen percent to debt.

Since 2020, almost one hundred forty asset, property or segment carve-outs have been completed across the electric and gas utility sectors. Often, management determined that a business segment or portfolio components did not fit their business profile and could be more appropriately owned by another entity.

See Figure 4.

But shrinking to grow does not solve the fundamental challenges in maintaining a healthy balance sheet. With the level of planned capital investment, utilities still need to strengthen capital structures and/or manage dividend payouts. Debt is not cheap today, and the years-long cycle of piling it on has weakened debt-to-total-capital ratios and funds from operations metrics, leaving a need for a new equity infusion across the sector.

This incremental and recurring level of investment likely needs to be funded creatively, such as through unconventional instruments and sources. In recent years, streamlining cost structures to offset or forgo rate increase requests, address increasing customer affordability issues, and/or strengthen internal cash flows for sustained capital investment and financial integrity became a focus.

Certain utilities are now recognized as serial cost-cutters and regularly attack baseline O&M expenses, while others pursue nominal cost take-out, falling further behind their peers.

Capital investment, portfolio rationalization and cost management all enhance a utility's strength.

If a company brings the right focus to the right assets with the right customers, an organic growth platform can emerge to provide a solid base for value. But the next step for utilities is to create a more integrated organic and inorganic growth platform for which M&A is a complementary means to enhancing total future value for shareholders.

Where We Are Going

More headwinds exist to complicate utility sector M&A than tailwinds to enable it. Headwinds reflect financial, market, and regulatory uncertainties, as well as difficulty aligning the interests of two merging utilities, most notably deal valuation and social issues.

Tailwinds propel future transactions if they help strengthen financial capability or advance the likelihood of transaction execution. The trick for utility leaders is to be acutely aware of prevailing winds, adroit in navigating them, and savvy in exploiting their shifts.

Today, sustained capital investment is a natural path to pursue — fueled by the energy transition, directed at reducing greenhouse gas emissions, and enabled by technology innovation. But even the boldest leaders recognize the high scrutiny capital investment is receiving as customer affordability concerns mount and growth targets of six to eight percent earnings per share (EPS) are subject to vagaries in capital availability, market opportunity, or regulatory action.

These factors illustrate why the extended drought in utility sector M&A may be coming to an end. Organic growth may not continue at the rates currently anticipated and could lead utilities to reconsider consolidation to either buttress core earnings or provide additional value through inorganic transactions. As a fundamental tenet, M&A can be a vehicle to simultaneously strengthen the business and enable emerging growth opportunities.

With new challenges to the prospect of utility sector M&A regularly materializing, thoughtful diligence, rigorous value assessment, and inspired execution become critical utility capabilities. These are particularly crucial to addressing strategy coherence, target evaluation, price discipline, and rapid integration. Future M&A should have a more stringent emphasis on value realization — how it is preserved and how it is optimized.

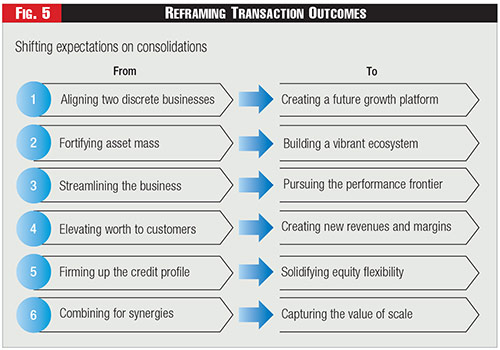

In prior cycles of U.S. utility M&A, attention usually focused on capturing value from available synergies through corporate center, operations support, functional integration, and sourcing economies, among others. But numerous companies have not been satisfied with an even more influential element affecting the enterprise — the value of scale.

With scale, a different lens can be applied to the existing business through which management attitude, structural design, operating simplicity, aggressive imagination, and rigorous intent can combine to enable broader optimization in embedded fixed costs, which have been notoriously difficult to address. These costs are institutionalized into policies (misaligned incentives), hardwired into systems (technical features), embedded in processes (decision hierarchies), and concealed as untouchable legacies (management prerogatives).

The next cycle of utility sector M&A is unlikely to be successful if it does not acutely focus on the value of scale. Simply extracting available synergies results in a foregone opportunity to build higher value, such as structuring and operating an enterprise to take advantage of size to build a platform that enables a broad value engine to be embedded within the business.

How Things Could Look Different

Given the near-one trillion-dollar size of the U.S. utility sector, the level of scale to be captured in future transactions will well exceed those that preceded. More importantly, the value of scale to result from future transactions will be a prime differentiator — the creation of bellwether utilities that are strategically architected, financially durable, operationally agile and produce sustainable, value-centered businesses.

The eighteen U.S. utilities with a market capitalization of over twenty billion dollars generally reflect companies created through multiple transactions in the modern era. The next wave of transactions will not only increase the number of companies over this threshold but could ultimately catapult smaller entities past ten billion dollars in market capitalization, midsize companies over twenty-five billion, large utilities above forty billion, and mega-utilities across the one hundred-billion-dollar threshold.

If any two utilities with twenty billion dollars in market capitalization combine, the new entity would become the seventh-largest U.S. utility. For two with twenty-five billion in market value, the new company would be the fourth largest in the sector.

These resulting new entities need to think about building platforms — portable, scalable, and flexible — to build and embed a way we work into a scale capture model. A platform-led entity creates a market advantage if it can devise a truly at-scale enterprise that leverages the benefit of size without maintaining unnecessary diversity or becoming unintentionally bespoke.

From a strategic perspective, this means adopting a one company model, such as conceptualizing an enterprise view of purpose and role, while operationally embedding a simplified, standardized, and integrated delivery model across the business.

Shortcomings reflected in prior transactions — the inability to capture the full value of scale — need to gain the full attention of a company's leaders to ensure success at enabling a platform to continuously drive economies of scale captured from capital spending, O&M costs, staffing levels, process designs, technology platforms, and performance outcomes.

See Figure 5.

More utility deals need to be styled as mergers of equals with lower market premiums to enhance the ability of leadership teams to capture and retain more benefits and synergies for customers and the future, rather than just-acquired company owners. This is rarified air, as the history of U.S. utility corporate stock-to-stock transactions is very limited, with analysis confirming only six completed below a ten-percent market premium.

Even with lower market premiums, utilities need to be cognizant of the starting and ending capital structures and balance sheets. To make transactions more workable and efficient, utilities need to explore and develop innovative financing vehicles that provide more flexibility or better economics, such as real equity-like instruments or modified recovery time frames.

The scale of transactions creates the potential for companies to employ a post-close merge-and-sell strategy. This could apply to properties or segments not pivotal to the value of the enterprise or could open incremental value sources by which new owners and/or operators are better positioned to pay higher premiums for desirable assets.

With the changes to traditional transactions that could emerge in the future, acquirors will be compelled to increase their focus on quantified synergies and other quantifiable benefits that inure to the benefit of customers.

This includes the traditional duplication, overlap, and economies of scale, and nontraditional synergies such as the application of artificial intelligence and robotic process automation to a combined operating company portfolio, or pursuit of the performance frontier. This means utilities need to be highly descriptive about the sources of all benefits available for all stakeholders in the near term and longer term.

In conjunction with this heightened focus on synergies and benefits, utilities need to create a compelling demonstration of synergy sources, types and levels, and a persuasive argument for recognition and recovery of both quantified synergies and costs. Achieving an equitable regulatory outcome in a transaction, i.e., equal sharing of net benefits between customers and shareholders, has long been the norm, even if not universally adopted across all states.

If transactions are well-conceived strategically, well-structured financially, and well-reasoned regulatorily regarding value sharing, then companies likely will have earned the license to merge, and customers and shareholders alike can win in a proposed deal.

The views reflected in this article are the views of the authors and do not necessarily reflect the views of Ernst & Young LLP or other members of the global EY organization.

Category (Actual):

Department: