Catastrophic Events Under Scrutiny

Todd Jirovec is a Dallas-based Principal with PwC Strategy& and has over twenty-five years of experience in strategy and operations consulting, particularly with electric and gas utilities, energy trading, and midstream gas companies. He currently leads the firm’s Power and Utilities strategy practice.

Hugh Le is a San Francisco-based Director with PwC Strategy& and has over ten years of experience in strategy and operations consulting. He has supported clients across utilities, power generation, renewable energy, and industrials. He leads engagements in asset and risk management, emergency planning and response, operating model design, capability maturity assessment, and risk-based investment planning.

Long before the COVID-19 pandemic, utilities faced an increasing number of catastrophic events. Hurricanes, storms, and wildfires still now increasingly grab headlines, with insured and uninsured losses increasingly setting records as well.

These incidents have the potential to cause massive disruptions to operations and customers, while attracting high levels of public and regulatory scrutiny. As the industry emerges from the initial onslaught of the COVID-19 crisis, it will likely need to address how it can ramp up its response to sudden, impactful events on the scale of a global pandemic or unusually catastrophic weather-related events. Toward this aim, regulators are requiring — and utilities are responding with — enhanced grid and pipeline resiliency programs to help fortify systems and reduce risk.

How risks are identified and mitigated are increasingly becoming part of the narrative to help justify investment plans going forward. Utilities are evolving their capital plans to speak in a new language that includes enhancement of operating and maintenance practices, system-hardening programs, and deployment of newer non-wires alternatives such as microgrids. As this transition unfolds, developing risk-informed investment plans should be required and be a part of the new normal that utilities face with these increasing risks.

A Changing Environment

The nature of risks and their ultimate consequences have changed. The impact of COVID-19 adds more factors to consider. As we've seen residential customers shelter in place, their reliance on power is paramount.

Utilities face the continued need for uptime and reliability, while also mitigating safety risks to employees, contractors, and customers. This is fundamentally challenging how utilities transmit and distribute gas and electricity to their customers and communities.

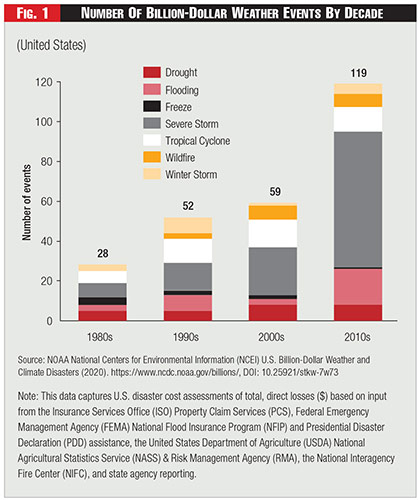

The number of catastrophic events, such as wildfires, severe storms, and winter storms, exceeding one billion dollars in costs has increased over the past four decades.

See Figure 1.

The increasing frequency of these events can also be observed through the lens of reliability impact. For example, according to reporting from the U.S. Energy Information Administration, electric system reliability has been impacted from an uptick in the number of major events days.

These events have not only fundamentally altered the communities impacted, but also the utilities that serve them. As might be expected, financial markets react negatively to these catastrophic events — whether or not utility equipment is implicated as the cause of an event.

According to PwC's analysis of nearly a dozen separate incidents, the share price of utilities declined on average approximately ten percent in the two years following incidents ranging from hurricanes, wildfires or system failures.

Following such events, communities and utilities must rebuild. Capital should be deployed to enable the gas to flow or the electricity to be reconnected. Nevertheless, the nature of the capital has changed. The assets being rebuilt today are not the same assets as those from five decades ago.

Moreover, the risks to the system have changed. Typical asset hardening (or replacement) plans are a good start but may not holistically consider risks present in the system. COVID-19 has delayed some of these plans since maintaining the system during the pandemic became the first order of business.

To add further complications, ongoing workforce impacts due to the virus may well have a lingering impact on how quickly work can be carried out. Grid resiliency is becoming a popular term to promote investments that will help improve both safety and reliability to challenges posed by the aging asset base and compounded by climate change.

Regulatory Response

As regulators fulfill their mandate to enable safe and reliable service at affordable rates, we are seeing traditional prudency standards evolving from used and useful to risk informed. Commissions should address the changing nature of risks and are now seeking justifications for capital and Operations & Maintenance investment plans that can address and quantify risks mitigated.

While not widespread as of yet, a number of states are setting the path for requiring risk-informed investment plans that require justification of capital plans in terms of the risks being addressed, how risks will be mitigated, and the quantification of those risks addressed relative to capital investment.

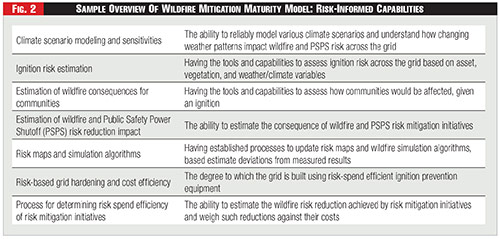

California is a leading example of how state Commissions will likely push for more risk-informed plans. The California Public Utilities Commission (CPUC) recently issued new guidance as part of the 2020 Wildfire Mitigation Plan.

Per the guidance, California's investor-owned utilities are required to indicate their maturity level as it relates to risk modeling and risk identification — both in the current state and the expected improvement in three years' time.

See Figure 2.

While the CPUC may have been emphasizing risk-informed planning as it relates to wildfires, these principles can easily be translated to other risks such as pandemic preparedness and response.

As Commissions prepare for weather-related risks such as hurricane or wildfire seasons, they should also look to regulate how utilities become resilient against another potential COVID-19 wave or future public health crises.

Additionally, the industry — as many other industries are discovering now — would do well to offer detailed industry leading guidance for the utilities to confirm not only dependable service but also the preparedness surrounding the safety of workers and customers.

The National Association of Regulatory Utility Commissioners and American Gas Association are among those industry bodies pushing for the increased adoption of risk-informed investment plans.

Utility Response

Many utilities are now spending considerable time identifying risks related to catastrophic events and public health crises and designing grid resiliency programs to help mitigate these risks. These grid resiliency programs typically have three components:

Enhanced operations and maintenance practices can be highly effective in preparing the grid for major events since they can often be the quickest mitigations to implement. For example, practices such as enhanced vegetation management for electric equipment and advanced leak detection for gas pipelines can remove threats from the grid by simply changing maintenance guidelines and requirements for field personnel and contractors that are already executing work.

Deploying split operations or even sequestration for critical employees (such as those in operating control centers) can be an effective way, for instance, to comply with social distancing requirements while protecting workforce health. Other examples include enhanced inspections, improved situational awareness, real-time system monitoring, and proactive de-energization in advance of weather threatening conditions;

System hardening can take many forms based on the risk a utility faces and maturity of the utility's risk assessment. Potential options can start with simple asset replacement or renewal, such as replacing old wood poles or gas main replacement, and quickly scale to upgrading the type of infrastructure deployed, such as undergrounding cables or coating gas pipes.

These solutions can be highly effective, because they provide reliability benefits during normal operating conditions, and offer increased preparedness for extreme conditions. Other examples include additional automatic control devices with SCADA capabilities, overhead conductor replacement, and tree-wire; and

Non-wires alternatives may offer the largest potential benefits but also require the greatest degree of change. Distributed energy resources, microgrids, and other possible solutions can help remove significant risk from transmission and distribution systems by upgrading assets and limiting exposure to weather events.

These investments require external partnerships, such as regulators, local governments, and private industry, and the costs required to achieve these benefits may present challenges on a different scale compared to other measures.

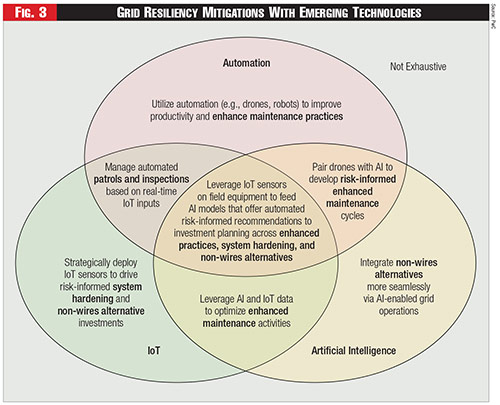

These approaches have already become a staple of sorts for many utilities, yet more is needed to achieve even smarter grids. As the push for improved grid resiliency continues, utilities are combining these concepts with emerging technology to help push the thinking on how utilities can address potentially increasing risks.

See Figure 3.

The savviest utilities not only utilize data analytics to help improve risk-based decision making, but also integrate it into their investment plans. Asset management functions are being augmented by data scientists who can integrate and assess multiple sources of records across asset data, as-built designs, operations data, customer usage, and environmental impacts.

These same data scientists can be leveraged to help improve responses to future health crises and workforce planning needs. Quantifying the risk reduction based on mitigation choices helps prioritize capital and O&M investment plans with an eye toward meeting the goals of grid resiliency.

Charting the Path Forward

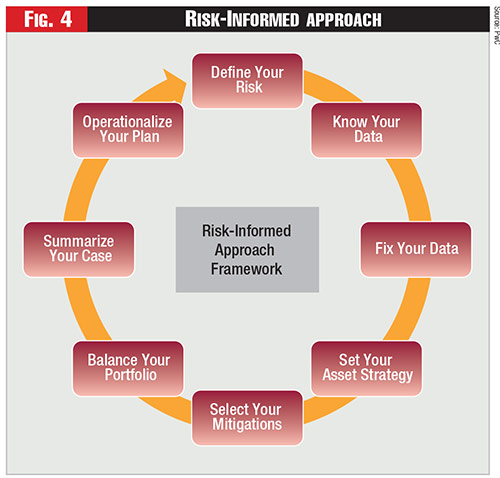

Mature utilities are well into their journey of achieving risk-based asset management and improving upon their industry leading risk-modeling capabilities. Those that have found — or are beginning to find — success are doing so by implementing the following risk-based approaches:

Define your risk — failure mode analysis and drivers, impacted assets, impacted critical workforce, and the consequences facing customers and utility operations;

Know your data — data that informs failure mode analysis, systems of record, combining multiple datasets to improve understanding of risk;

Fix your data — understanding of gaps in data sources, traceable/verifiable records;

Set your asset strategy — risk tolerance thresholds, such as choices surrounding repair, replacement, or potential removal of assets;

Select your mitigations — potential mitigations list, analysis of alternatives, feasibility analysis;

Balance your portfolio — risk-spend efficiency modeling based on resource and financial constraints and optimizing for a given level a capital and expense;

Summarize your case — risk-driven plan with summary of customer benefit and impact; and

Operationalize your plan — execution of work plan and measuring risk reduction results.

See Figure 4.

Utilities that have embraced risk-informed investment planning can better communicate investment plans to regulators, employees, customers, and local communities. Climate change and an aging infrastructure have fundamentally altered the nature of risks to a utility operator.

COVID-19 further highlighted weak links in the industry's risk assessment capabilities and underscored why these risks should be addressed quickly, especially if work delays are potentially exacerbated by workforce absenteeism.

Utilities should adapt to these risks and understand that much of what can be done is already in their toolkit. The ability to develop risk-based asset management decisions can and should be improved to produce plans that help reduce the greatest amount of risk for the most efficient use of capital and O&M invested.

Category (Actual):

Department: