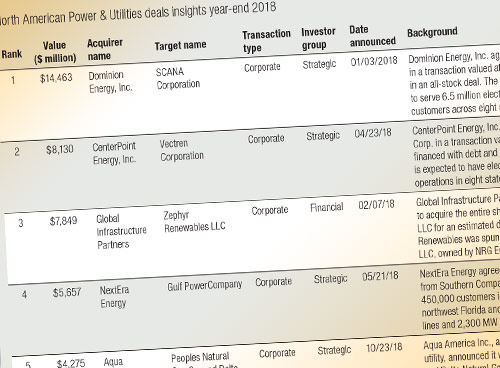

Snapshot of Top Ten Deals

Jeremy Fago is the US Power & Utilities Deals Leader for PwC.

PUF's Steve Mitnick: What are your roles and responsibilities here at PwC?

Jeremy Fago: I lead our Power & Utilities Deals group here in the United States, which is all things deal-related. My primary job is to make sure that our clients have access to our deep and broad set of expertise when it comes to deals. That could be for valuation related items, due diligence, tax structuring, or complex accounting.

It's the technical aspects of those activities, as well as items like integration support and strategic rationale and implementation support. It's anything and everything that you can think of from a deal perspective. It's my job to make sure that we're connecting the dots with our clients on their needs and bringing our deep bench of subject matter experts to address those needs.

PUF: How did your career lead you to this position?

Jeremy Fago:I've been in the industry for over twenty-five years. I started in the industry, then spent a better part of the previous decade working on a lot of the merchant bankruptcy restructurings. I joined the firm in 2010, to build up and develop a Power & Utilities focused deals platform.

PUF: Define what you mean by deals?

Jeremy Fago: We handle mergers and acquisitions, divestitures, IPO support. Really anything of a transactional nature.

PUF: In your annual report, you point out that the total value of the deals has been decreasing a little in the last few years. But there are mega deals that we've read about in the news and know are going on in the industry.

Jeremy Fago:It's an interesting dynamic. When you look at that, it's a bit of a relative comparison. I know I'm going back in time but look at 2016. Most compare to that year, and that was a banner year from a deal value perspective.

There were significant mega-deals announced that year. Lots of mergers were being announced, huge dollar deals. This is a relatively small industry from the standpoint of number of players that are in a position to do what we define as a mega-deal of $5 billion or more. There are only so many deal-makers out there that can pull off mega-deals on a recurring basis. (See Figure 1, Snapshot of Top Ten Utility Deals of 2018, in pdf format here.)

What we've seen, however, is that activity from a volume perspective is very consistent for '16, '17, and '18. The deals have changed, and the size of the deals have changed a little bit, but the volume of activity is still very much in a robust situation. The other aspect of that is, in '16, there were these big deals.

I'm going to go a little bit deeper here, but because of the valuations and the premiums that have been paid in the industry, there's a big focus on the strategic growth initiative associated with those synergies.

When you see premiums that are in the thirty or forty percent range, ten years ago we were finding ten percent premiums. Those premiums represent synergies. With ten percent premiums, you can address a lot of the value capture through cost takeout or efficiency gains and economies of scale, and things of that nature. When you start getting to forty or fifty percent premiums, you can't address that with just pure cost, or efficiency advantages.

One input into the higher valuations we saw is the low interest rate environment we've been in since the recession. Making deals accretive with low interest debt is one advantage.

But the other aspect of that is, when you look at the types of deals that some of those mega-deals represented, it was effectively buying platforms that had significant growth opportunities.

Maybe on the standalone basis those platforms weren't able to optimize that but the marriage of a larger balance sheet with those platforms to support all of the infrastructure needs that we have in this industry with generation shifting from in a lot of cases, coal in particular, as well as nuclear, to renewables and natural gas both from a baseload, as well as peaking capacity need for renewable backstop.

With that shift in generation comes all of the infrastructure to support that, such as electric transmission, gas pipeline and gathering, laterals, and all of that is a significant infrastructure need. A lot of the values that we saw being paid were to get in on the platforms to support those initiatives and deploy capital long term into those platforms to address those needs.

PUF: What are a couple of examples of those 2016 mega-deals?

Jeremy Fago: I can't name any specifically, but if you look at those deals, you see some significant regulated transactions, and you see some transactions, particularly in the regulated gas pipeline space. That's one of those areas where we saw a lot of capital flow.

We talk about, any time you change how we get our electricity, and the fact that we've got shale gas, which changed where we get our natural gas supplies, there's significant investment need in that pipeline infrastructure as an example.

It's not just for the utilities that are vertically integrating back into pipeline, because their portfolio from a generation perspective is shifting to gas, but also more broadly in the industry for things like midstream pipelines.

Those strategies take time, not only to formulate, but to integrate. From all of those announcements from '16, we've seen a lot of those big players really focus on the organic application of those acquisitions. It's executing on the strategy of the growth agenda.

They made those inorganic deals in '16 and have since been executing on extracting those premiums or those synergies from the deals that were completed in '16. We've seen a lot of large players focus on that aspect, and I think there's more to come because there are significant challenges in the industry with the changes we're seeing in the industry.

It's a relative discussion, because we haven't felt a significant slowdown in the mergers and acquisitions field. It's been more of a value conversation versus volume.

PUF: In 2018, on your list of some of the larger deals, there's Dominion and SCANA, but also CenterPoint and Vectren. That's emblematic that the number of investor-owned utilities continues to decrease with consolidation.

Jeremy Fago: There's been significant consolidation over the last few decades. The number of investor-owned utilities as you compare ten years ago to now has shrunk precipitously. That is still a conversation point.

There's still opportunity for consolidation in the industry, because the shift from coal and nuclear to renewables and natural gas isn't necessarily slowing down.

There's a big drive, particularly from our sector clients, to continue to drive renewables into portfolios. The States are going to continue to push that agenda as well, and with that comes challenges as far as how you manage the grid and manage the intermittency that those renewables present absent very near-term breakthroughs on the electric storage side, in particular for utility scale.

We still think there's going to be consolidation. We still think that deals are going to be a focal point as the industry looks to address the challenges that we have ahead of us.

PUF: Several of the larger deals have to do with portfolios of renewables. The ConEd deal, and NextEra's always active, but others too. Is there much demand to scale up in renewables?

Jeremy Fago: Yes, I think that's right. I mean, it's bespoke depending on where you're sitting. As you think of some of the mandates that are out there on a state-by-state basis, certainly that's going to drive incentive for developers and we still have some tail on federal tax incentives too.

In some cases, utilities looked at that and said, let's look at meeting our mandates through self-build and getting that return of, and on, capital. In other cases, players looked at developing, owning and operating renewables through non-regulated affiliates to support the opportunities presented in several states, not necessarily their own, through RPS standards and given the stable earnings profile those long-term contracts provide allows the portfolio to fit the stable, yielding profile their investors are looking for. As well, non-utility investors and developers have continued to play a leading role in building out those renewable portfolios.

The other aspect of that is, when we look at renewables, fifteen years ago we were talking about long-term contracts on combined-cycle generation. That for the most part doesn't exist right now given how we have general oversupply currently.

But on the renewable side, fifteen to twenty-year long-term contracts with A-rated off-takers, is a pretty desired spot to be in for many investors, particularly in a low interest rate environment, where that thirst for yield has been significant over the last decade since the recession.

From a regulated or hybrid utility perspective, folks continue to look at that because if you're traded as a utility on yield, those contracted renewable assets and portfolios have some utility-like qualities from an earnings perspective. That's predictability of cash flows, and for all intents and purposes those cash flows are yielding investments. They fit more nicely sometimes, into that utility fold as far as what that earnings profile looks like.

We saw five to eight years ago, where a lot of the regulated utilities or hybrids that had non-regulated generation looked to shed those portfolios because of the volatility of that cash flow. They were at the mercy of the market from a commodities perspective.

If you're a P/E traded utility, that volatility is hard sometimes for a dividend investor looking to predictable yield to accept. Renewables, I believe, with fifteen- or twenty-year contracts sit very nicely into that yielding type of investment and are a fine profile for P/E traded investors.

PUF:You're saying that's like where utilities try to go back to being pure utilities because of volatility and being affected by the price of natural gas. Now what we're seeing is some going out to non-utility assets, but the renewable assets have long-term contracts that are not based on the volatility of natural gas.

Jeremy Fago:That's right. The industry is continuing to evolve and shift into greener platforms. The customer has become much more front and center over the last decade so there's a lot of focus on customer needs, and interactions with the customer, and the customer wants. For the most part, they want to feel good about energy they're procuring, and that's been a big highlight for the sector.

We have seen a big focus by not just regulated utilities, but even some of the non-regulated IPPs, to retail businesses, to get closer to that customer. First is being the wholesale provider of electricity, or even the retail provider, but maybe not having that connectivity with the customer.

The customers want connectivity, a user interface that we experience in other industries. They want it at a cheap price, and they want it to be reliable, so those challenges play into why we're seeing investments on certain platforms as a result. We're balancing that with, what is our investor base, and how are they going to think of this from a valuation perspective?

PUF: In a deal, dependent upon their nature, there's regulation, they have to be different bodies in the public, and they have to be persuaded as to why these are good for the customer and the public. Tell me about how the trend in deals helps the customer and is good for the public. What do people say in that area these days?

Jeremy Fago: You hit on the nuance of this industry, because in a lot of industries you're managing your investors as well as the customer, and those two things go hand in hand. In this industry, you've got a regulator that sits in the middle of that as well, and if the customer isn't happy, certainly your regulator isn't going to be happy.

We see a lot of the deals, and we do expect to see more of this, where we hit on the renewable platforms. That's clearly one of the areas where investors desire to play a role. There are obviously financial benefits too, but the customer desires certainly play a role in driving some of that investment.

We'll continue to see our clients look at opportunities through technology, for example, through battery storage, digital platforms, potentially the use of AI and automation, as just a few examples. Solutions on the technology side that help with efficiency gain and overall customer experience.

As we go through the next five years, we're going to see capital flow into those platforms which will obviously look a little different than what we're historically used to in the traditional utility model.

It may even involve players that aren't traditionally seen as being in the power and utilities industry. We've already seen a bit of that. But we're going to continue to see that evolve. The challenge, frankly, for this industry, and one of the avenues that our clients really focus on is making sure that they're managing that regulatory aspect of it as well.

It's a space where making big bets on certain aspects of business that aren't necessarily fully understood or fully formed or proven at this point in the utility space can be a risk as far as getting allowance for those capital investments.

Managing the benefits, the cost efficiency, and the real impact of those capital investments is going to continue to be a significant focus for utility players when they think about where to put that money and balance that against the overall infrastructure needs of these portfolios.

Where do I put my capital? How do I evaluate that spend? What are the benefits, not only to the customer, but how are my investors going to see that? Then it comes down to the hard question of, how do I measure that return if it's a technology play versus going and building a pipeline for example?

Those are two different valuation analyses, effectively, and we tend to spend quite a bit of time with our clients on the how do you measure those two on a comparative basis? That's where that challenge lies, in managing that regulatory aspect of it, balancing that against where you strategically see the most value, not only to your investors but to your customers.

PUF: Two years from now will there be any surprises? What can we expect? Is it going to be the same kind of conversation or do you see any turning points?

Jeremy Fago: If you could get back to me in five years, that probably is a different conversation than a year from now. I think we're going to continue to see this evolve, and big steps is a little bit strong, but it's going to take time and it's going to be measured, as far as how this evolves.

We see utilities, for example, playing a platform role in a lot of cases going forward. Where they are not only a provider, but an enabler for others who want things like microgrids or distributed technologies, or other types of technology and user experience that you've seen some non-utility players get involved in.

That's going to be the interesting evolution, but this isn't going to move overnight. The industry isn't built that way today, and again when you layer on the regulatory construct, and what that's meant to do, and how that impacts customers directly, that's just by design, going to take some more time to get there.

I think this conversation continues and evolves in the next year. I don't think we're sitting here next year shocked by something that we're not contemplating, because the industry is moving in that direction, but it's certainly going to have to be balanced with the other needs that we have in this industry in this country.

Infrastructure first, as you think about shifts in that, with the technology and continued development on the renewables and energy storage side will continue to evolve. It won't happen overnight but that's the direction we're headed.

Category (Actual):

Department: