Question Worth Asking, But Answer’s Unclear

Phillip Cross is Public Utilities Fortnightly’s legal editor. He also serves on the editorial staff of Utility Regulatory News, published by Public Utilities Reports, Inc., PUF’s publisher. URN reports weekly on ratemaking and regulatory decisions issued by state public utility commissions.

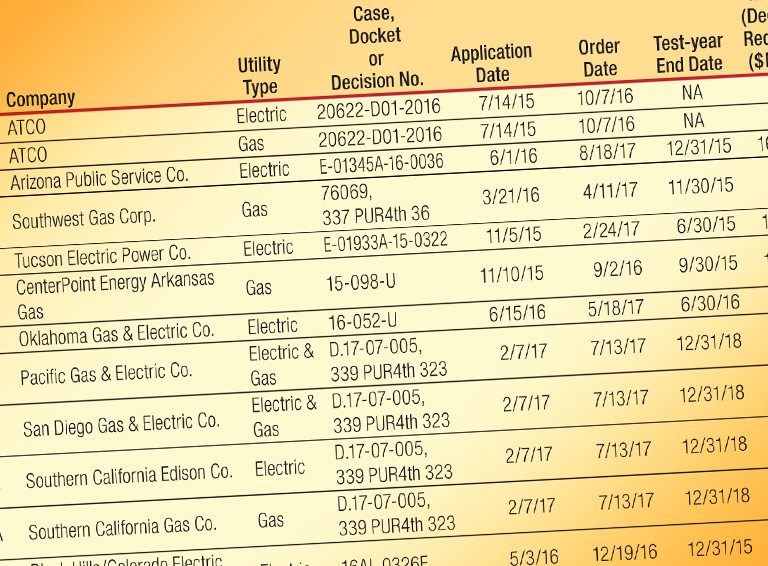

This year's annual survey of electric and gas retail rate cases lists as many cases decided as in some prior years. (We have been doing this for some thirty-five years now.) And the percentage awards for rate of return on common equity appear to be holding pretty much steady, as compared with prior periods. Nevertheless, the last twelve months saw a significant number of the nation's top utilities experiencing a major increase in rates. Here is the survey table in PDF format.

Which factor drives the result? Which factor takes the lead these days in pushing up or down the size of the awarded rate increase?

One way to look at this is by comparing the total revenue a utility claims that it needs — to both cover expenses and pay a fair rate of return — with the amount actually awarded by the commission. When combined with a high level of projected investment, the difference between the return on equity requested, and the figure actually awarded, demonstrates the importance both play in setting the total revenue requirement that consumers must pay in rates.

Utilities continue to argue for higher return on equity, in excess of ten percent (which would drive retail rates higher, all else being equal). But the cases suggest that much of the recent rate case activity may well reflect a flurry of plans proposed by utilities for significant investments in new infrastructure.

It appears that, in many cases, regulators accept the premise that rates must go up to reflect a need for significant investment in coming years. At the same time, when it comes to the issue of a fair return on equity, a continued trend toward somewhat lower cost of capital findings acts to reduce the cost burden on consumers by a significant margin.

In this light, let's look at three recent rate cases — involving Otter Tail Power, Northern States Power and Consumers Energy — handed down this past year in Minnesota and Michigan.

Otter Tail Power

Noting that it had been seven years since an electric utility had last raised its base rates, the Minnesota Public Utilities Commission agreed this past year to a rate increase for Otter Tail Power of about two-thirds of the amount requested ($12.29 million, on a request of $19.30 million). Even though the utility appeared to be planning a capital expansion plan that would rank as the largest in the company's history.

In seeking additional revenues, Otter Tail Power stated in its petition that from 2012 to 2015, it had devoted $536 million to various capital projects. Plus, it attested, over the five-year period of 2016 to 2020, it expected to invest at least another $858 million in system expansions and improvements, primarily in environmental safeguards and transmission-related upgrades and extensions.

Yet while Otter Tail had premised its rate petition on an authorized return on equity of 10.05 percent, the Minnesota commission ultimately adopted a return of 9.41 percent. It was this paring of the requested return that played the lead role in cutting some one-third of Otter Tail's request.

Re Otter Tail Power Co., Docket No. E-017/GR-15-1033, May 1, 2017 (Minn.P.U.C.).

Northern States Power

In another retail rate case decided this past year, the Minnesota commission put its thumb on the scale in favor of capital expansion as a key rate case driver. It decided for the first time to invoke a 2011 state law allowing energy utility rates to be established for a multi-year period — up to a maximum of five years — rather than be prosecuted only on a straight annual basis.

In enacting the law, the legislature had supposed that by assuring more up-front funding for plant expansions and improvements, and eliminating costly and repetitious rounds of rate-making proceedings, utilities could engage in more cohesive long-term planning.

The case involved Northern States Power Co. (doing business as Xcel Energy). The company submitted a rate increase application in late 2015, proposing a three-year electric rate plan that would raise rates by $194.6 million in 2016, $52.1 million in 2017, $50.4 million in 2018. In the end, the commission adopted a partial settlement encompassing a four-year deal.

Under the schedule set forth in the stipulated settlement, the company was awarded $74.99 million in rate relief for 2016, $59.86 million for 2017, $50.12 million for 2019. However, rates will not rise in 2018.

Re Northern States Power Co., Docket No. E-002/GR-15-826, June 12, 2017, reported at 337 PUR4th 74 (Minn.P.U.C.).

Consumers Energy

Earlier this past year, the Michigan Public Service Commission applied both drivers — return on equity and rate base — in cutting by half a $225 million rate increase proposed by Consumers Energy.

On the one hand, the commission decreased the utility's proposed 10.7 percent return on equity. It authorized a rate of 10.1 percent, accounting for much of the reduction in the utility's recommended revenue requirement.

The commission also decided that the company requested too-high capital investment needs as well. It acknowledged the propriety of grid modernization programs put forth by the company. But it noted the company had presented ambitious capital spending plans in the past, then lagged in expending the funds charged to ratepayers.

Reductions to the level of investment making it into in rate base played a large part in the ultimate decision by the commission, to significantly cut the company's request.

The commission authorized the company to increase spending on grid modernization projects and vegetation control programs by a more modest amount, $40 million for the former, $48.5 million for the latter.

Re Consumers Energy Co., Case No. U-17990, Feb. 28, 2017, reported at 336 PUR4th 176 (Mich.P.S.C.).

Category (Actual):